Summary

We study the Johansen-Ledoit-Sornette (JLS) model of financial market crashes (Johansen, Ledoit, and Sornette [2000] "Crashes as Critical Points." Int. J. Theor. Appl. Finan. 3(2) 219-255). On our view, the JLS model is a curious case from the perspective of the recent philosophy of science literature, as it is naturally construed as a "minimal model" in the sense of Batterman and Rice (Batterman and Rice [2014] "Minimal Model Explanations." Phil. Sci. 81(3): 349-376) that nonetheless provides a causal explanation of market crashes, in the sense of Woodward's interventionist account of causation (Woodward [2003]. Making Things Happen. Oxford:Oxford University Press).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

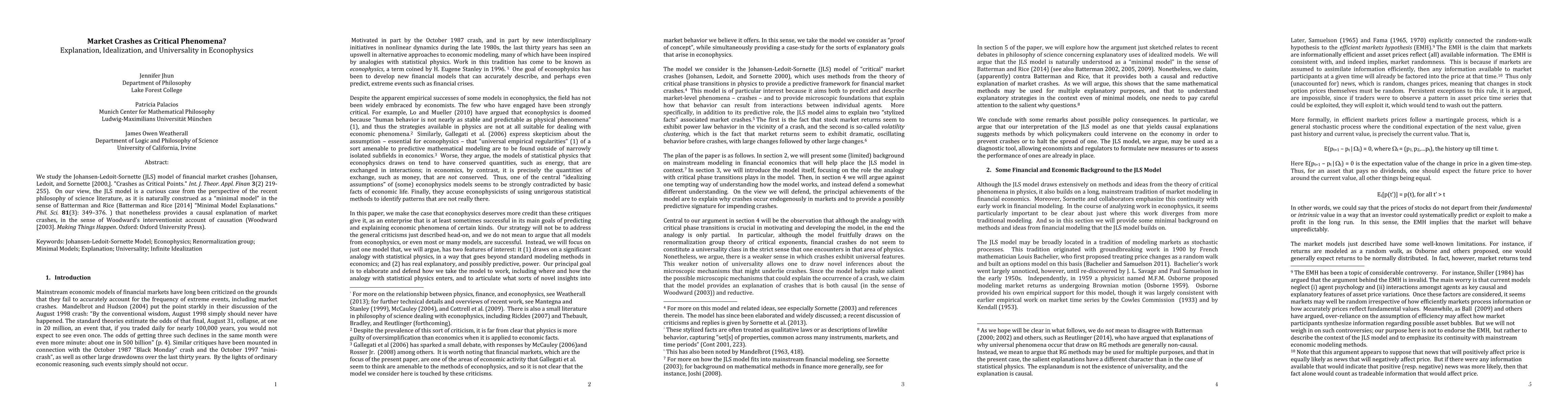

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)