Summary

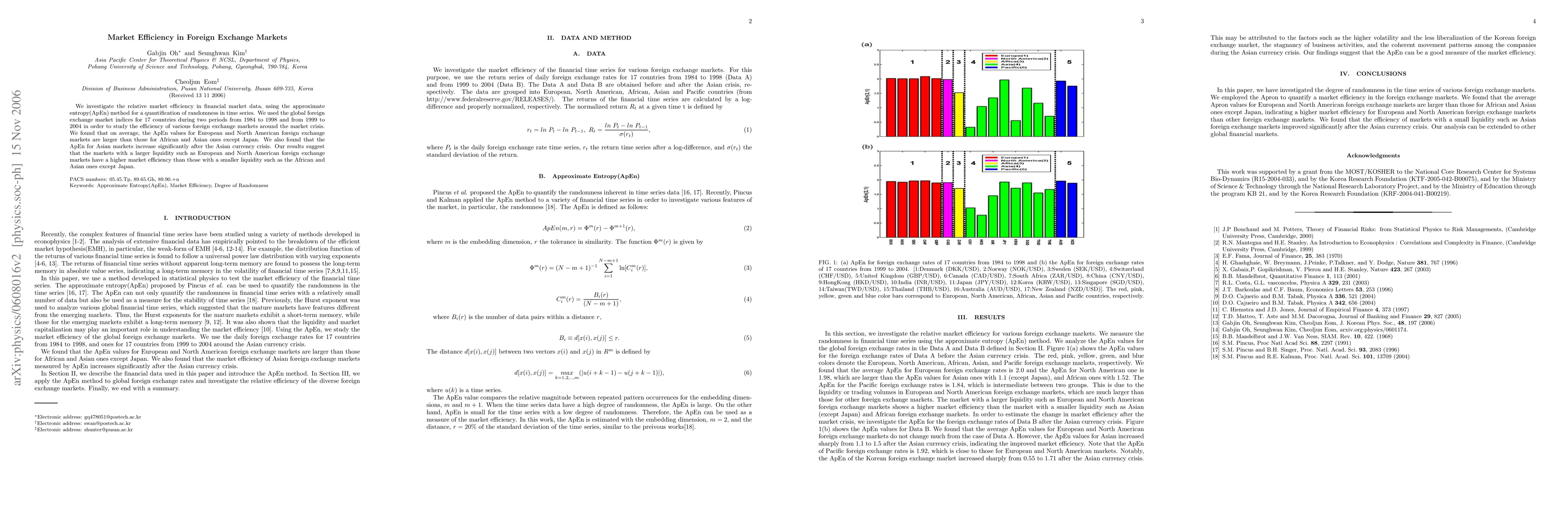

We investigate the relative market efficiency in financial market data, using the approximate entropy(ApEn) method for a quantification of randomness in time series. We used the global foreign exchange market indices for 17 countries during two periods from 1984 to 1998 and from 1999 to 2004 in order to study the efficiency of various foreign exchange markets around the market crisis. We found that on average, the ApEn values for European and North American foreign exchange markets are larger than those for African and Asian ones except Japan. We also found that the ApEn for Asian markets increase significantly after the Asian currency crisis. Our results suggest that the markets with a larger liquidity such as European and North American foreign exchange markets have a higher market efficiency than those with a smaller liquidity such as the African and Asian ones except Japan.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)