Summary

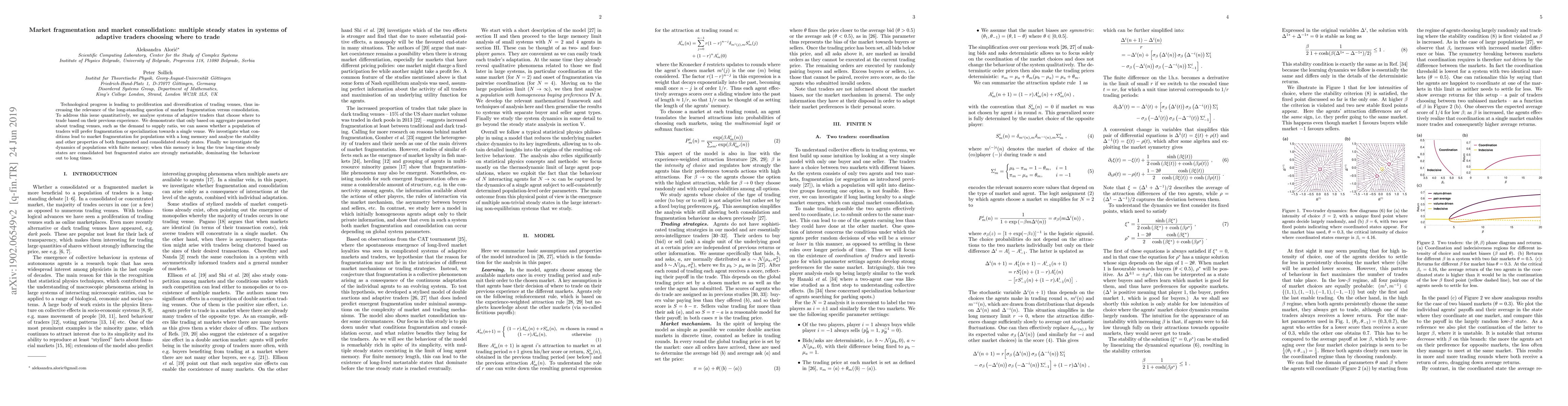

Technological progress is leading to proliferation and diversification of trading venues, thus increasing the relevance of the long-standing question of market fragmentation versus consolidation. To address this issue quantitatively, we analyse systems of adaptive traders that choose where to trade based on their previous experience. We demonstrate that only based on aggregate parameters about trading venues, such as the demand to supply ratio, we can assess whether a population of traders will prefer fragmentation or specialization towards a single venue. We investigate what conditions lead to market fragmentation for populations with a long memory and analyse the stability and other properties of both fragmented and consolidated steady states. Finally we investigate the dynamics of populations with finite memory; when this memory is long the true long-time steady states are consolidated but fragmented states are strongly metastable, dominating the behaviour out to long times.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Making with Fads, Informed, and Uninformed Traders

Leandro Sánchez-Betancourt, Emilio Barucci, Adrien Mathieu

| Title | Authors | Year | Actions |

|---|

Comments (0)