Authors

Summary

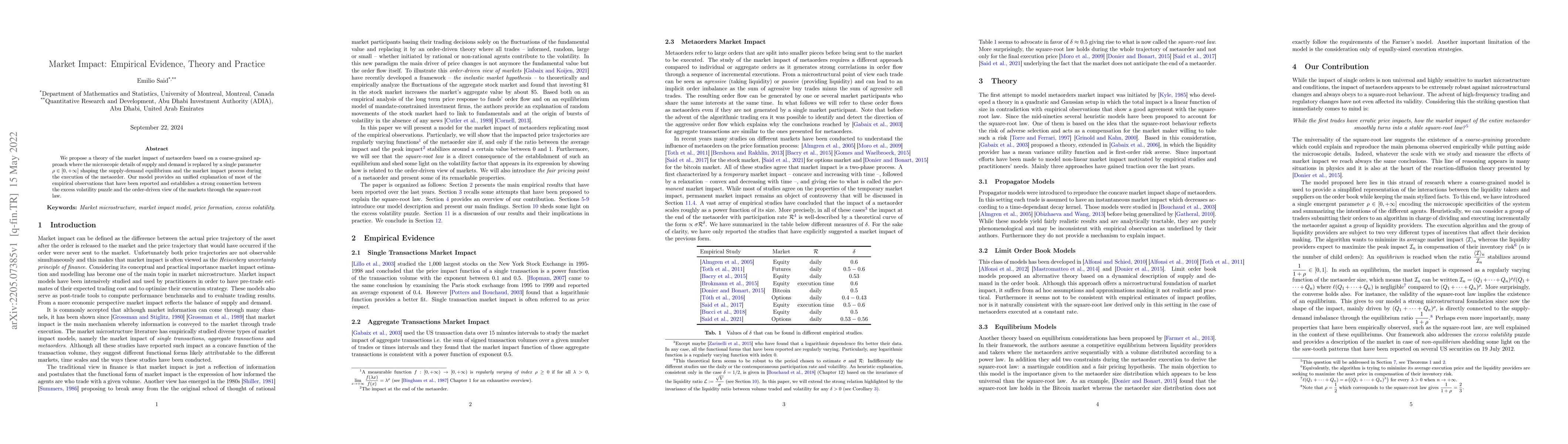

We propose a theory of the market impact of metaorders based on a coarse-grained approach where the microscopic details of supply and demand is replaced by a single parameter $\rho \in [0,+\infty]$ shaping the supply-demand equilibrium and the market impact process during the execution of the metaorder. Our model provides an unified explanation of most of the empirical observations that have been reported and establishes a strong connection between the excess volatility puzzle and the order-driven view of the markets through the square-root law.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA theory of passive market impact

Mathieu Rosenbaum, Grégoire Szymanski, Youssef Ouazzani Chahdi

| Title | Authors | Year | Actions |

|---|

Comments (0)