Summary

Our goal in this paper is to study the market impact in a market in which the order flow is autocorrelated. We build a model which explains qualitatively and quantitatively the empirical facts observed so far concerning market impact. We define different notions of market impact, and show how they lead to the different price paths observed in the literature. For each one, under the assumption of perfect competition and information, we derive and explain the relationships between the correlations in the order flow, the shape of the market impact function while a meta-order is being executed, and the expected price after the completion. We also derive an expression for the decay of market impact after a trade, and show how it can result in a better liquidation strategy for an informed trader. We show how, in spite of auto-correlation in order-flow, prices can be martingales, and how price manipulation is ruled out even though the bare impact function is concave. We finally assess the cost of market impact and try to make a step towards optimal strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

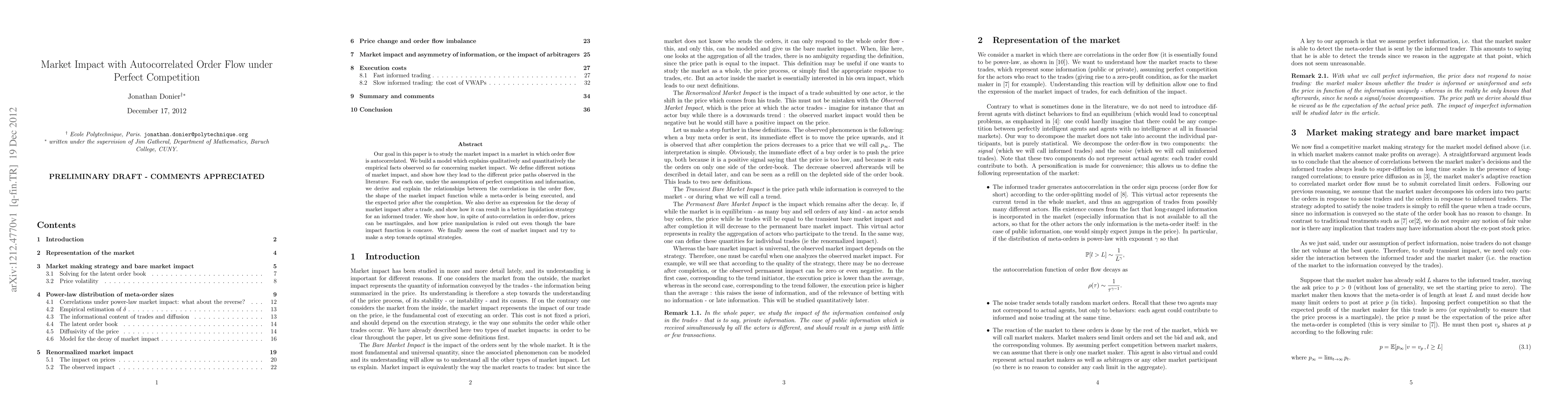

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInvestment Decisions for Perfect and Imperfect Competition in Ireland's Electricity Market

Davoud Hosseinnezhad, Mel T. Devine, Seán McGarraghy

| Title | Authors | Year | Actions |

|---|

Comments (0)