Summary

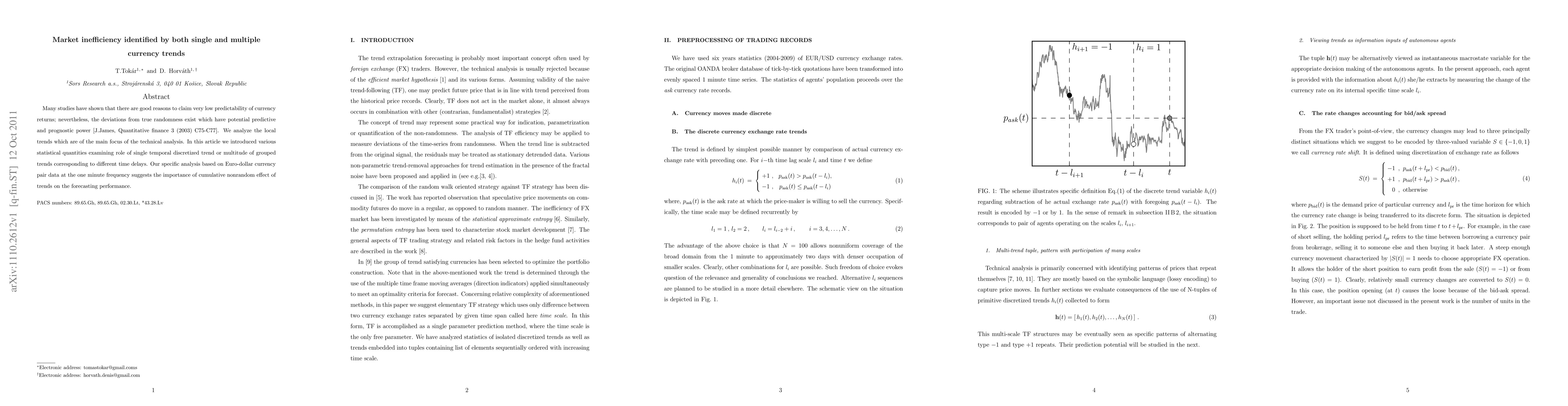

Many studies have shown that there are good reasons to claim very low predictability of currency nevertheless, the deviations from true randomness exist which have potential predictive and prognostic power [J.James, Quantitative finance 3 (2003) C75-C77]. We analyze the local trends which are of the main focus of the technical analysis. In this article we introduced various statistical quantities examining role of single temporal discretized trend or multitude of trends corresponding to different time delays. Our specific analysis based on Euro-dollar currency pair data at the one minute frequency suggests the importance of cumulative nonrandom effect of trends on the forecasting performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)