Summary

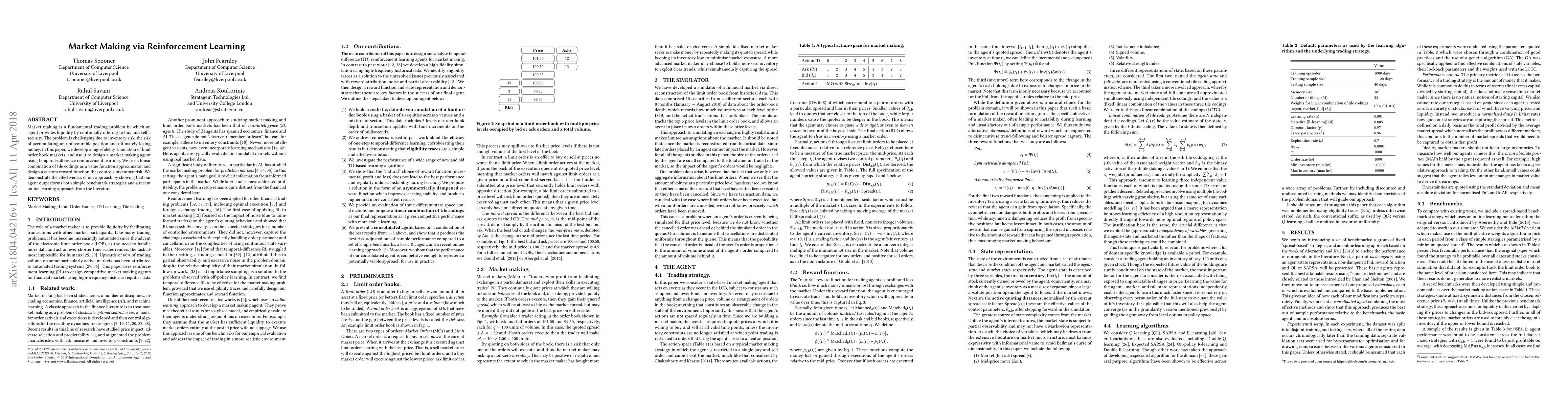

Market making is a fundamental trading problem in which an agent provides liquidity by continually offering to buy and sell a security. The problem is challenging due to inventory risk, the risk of accumulating an unfavourable position and ultimately losing money. In this paper, we develop a high-fidelity simulation of limit order book markets, and use it to design a market making agent using temporal-difference reinforcement learning. We use a linear combination of tile codings as a value function approximator, and design a custom reward function that controls inventory risk. We demonstrate the effectiveness of our approach by showing that our agent outperforms both simple benchmark strategies and a recent online learning approach from the literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarket Making via Reinforcement Learning in China Commodity Market

Junshu Jiang, Thomas Dierckx, Wim Schoutens et al.

Over-the-Counter Market Making via Reinforcement Learning

Zhou Fang, Haiqing Xu

| Title | Authors | Year | Actions |

|---|

Comments (0)