Authors

Summary

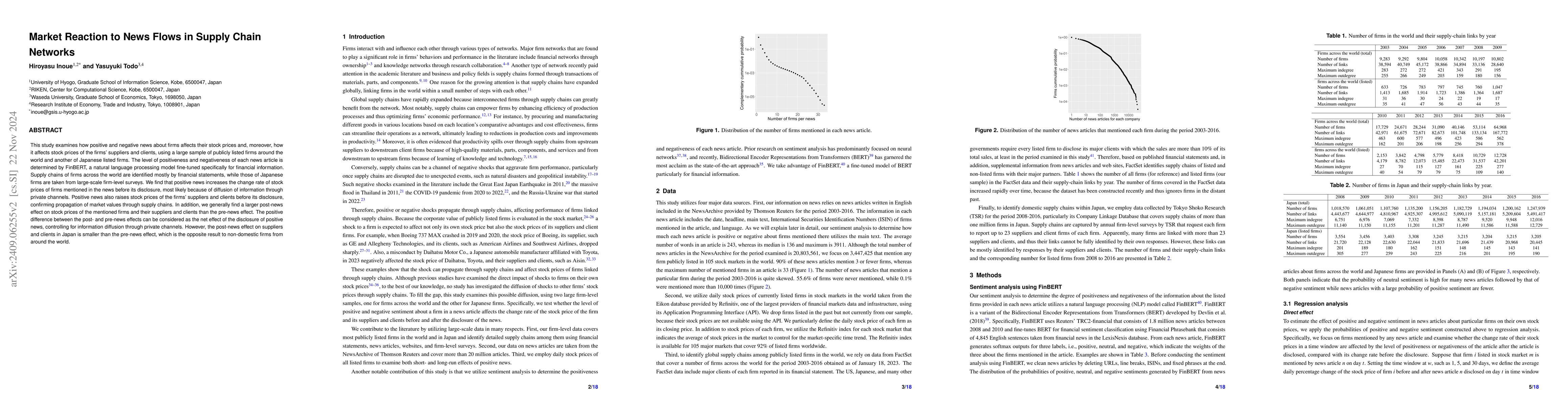

This study examines whether positive news about firms increases their stock prices and, moreover, whether it increases stock prices of the firms' suppliers and customers, using a large sample of publicly listed firms across the world and another of Japanese listed firms. The level of positiveness of each news article is determined by FinBERT, a natural language processing model fine-tuned specifically for financial information. Supply chains of firms across the world are identified mostly by financial statements, while those of Japanese firms are taken from large-scale firm-level surveys. We find that positive news increases the change rate of stock prices of firms mentioned in the news before its disclosure, most likely because of diffusion of information through informal channels. Positive news also raises stock prices of the firms' suppliers and customers before its disclosure, confirming propagation of market values through supply chains. In addition, we generally find a larger post-news effect on stock prices of the mentioned firms and their suppliers and customers than the pre-news effect. The positive difference between the post- and pre-news effects can be considered as the net effect of the disclosure of positive news, controlling for informal information diffusion. However, the post-news effect on suppliers and customers in Japan is smaller than the pre-news effect, a result opposite to those from firms across the world. This notable result is possibly because supply chain links of Japanese firms are stronger than global supply chains while such knowledge is restricted to selected investors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTraceability Technology Adoption in Supply Chain Networks

Georgina Hall, Philippe Blaettchen, Andre P. Calmon

Bullwhip Effect of Supply Networks: Joint Impact of Network Structure and Market Demand

Jianxi Gao, Chencheng Cai, Jin-Zhu Yü

No citations found for this paper.

Comments (0)