Summary

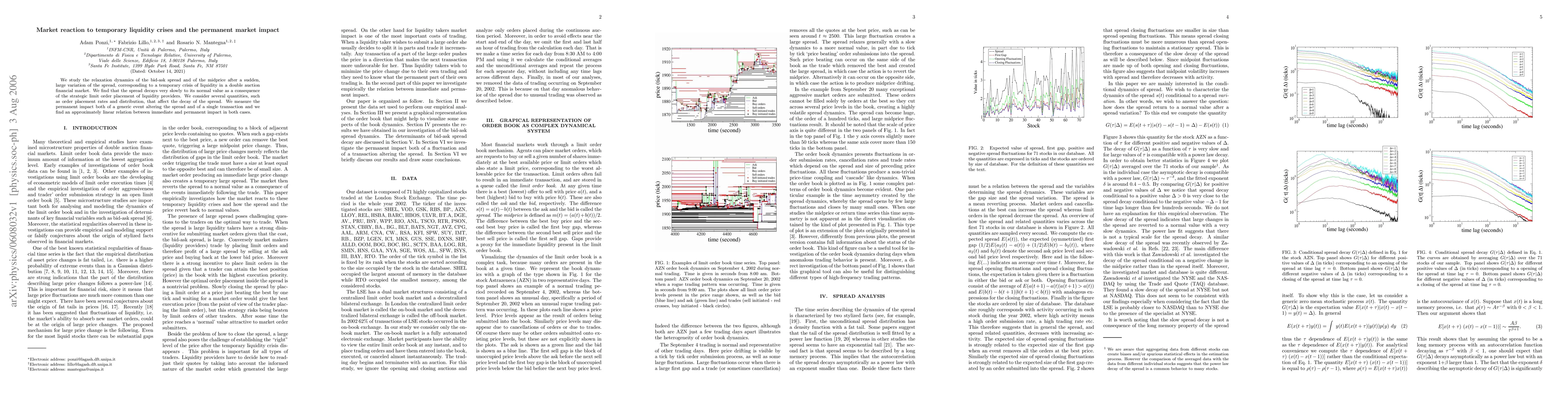

We study the relaxation dynamics of the bid-ask spread and of the midprice after a sudden, large variation of the spread, corresponding to a temporary crisis of liquidity in a double auction financial market. We find that the spread decays very slowly to its normal value as a consequence of the strategic limit order placement of liquidity providers. We consider several quantities, such as order placement rates and distribution, that affect the decay of the spread. We measure the permanent impact both of a generic event altering the spread and of a single transaction and we find an approximately linear relation between immediate and permanent impact in both cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersThe Impact of Designated Market Makers on Market Liquidity and Competition: A Simulation Approach

Cong Zhou

Transient impact from the Nash equilibrium of a permanent market impact game

Fabrizio Lillo, Francesco Cordoni

Comments (0)