Summary

In this paper, we consider a discrete time economy where we assume that the short term interest rate follows a quadratic term structure of a regime switching asset process. The possible non-linear structure and the fact that the interest rate can have different economic or financial trends justify the interest of Regime Switching Quadratic Term Structure Model (RS-QTSM). Indeed, this regime switching process depends on the values of a Markov chain with a time dependent transition probability matrix which can well captures the different states (regimes) of the economy. We prove that under this modelling that the conditional zero coupon bond price admits also a quadratic term structure. Moreover, the stochastic coefficients which appear in this decomposition satisfy an explicit system of coupled stochastic backward recursions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

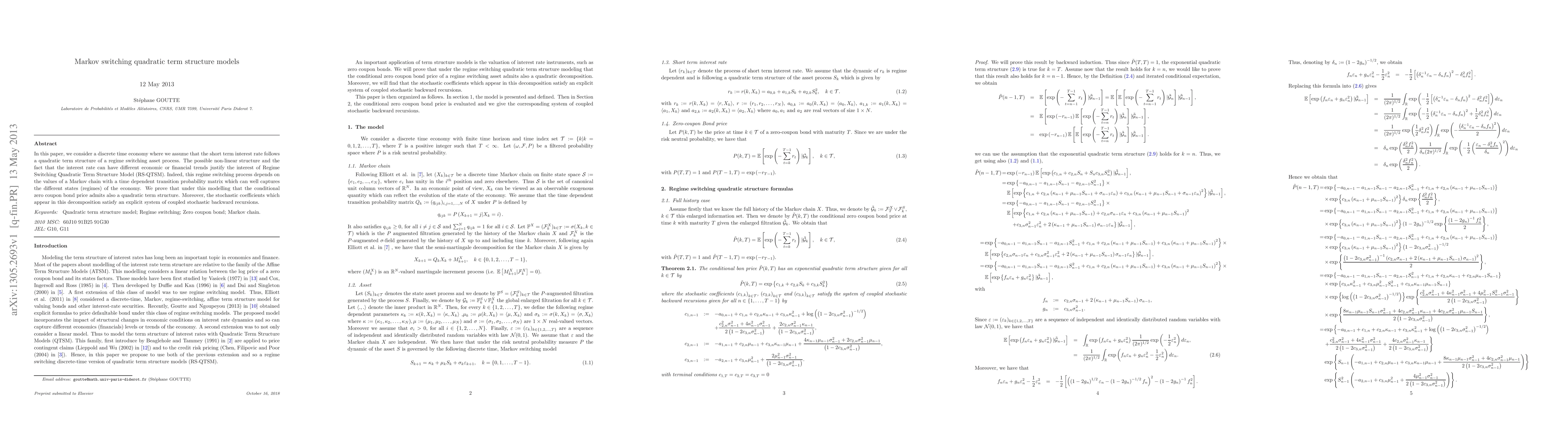

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)