Summary

We characterize the Markovian and affine structure of the Volterra Heston model in terms of an infinite-dimensional adjusted forward process and specify its state space. More precisely, we show that it satisfies a stochastic partial differential equation and displays an exponentially-affine characteristic functional. As an application, we deduce an existence and uniqueness result for a Banach-space valued square-root process and provide its state space. This leads to another representation of the Volterra Heston model together with its Fourier-Laplace transform in terms of this possibly infinite system of affine diffusions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

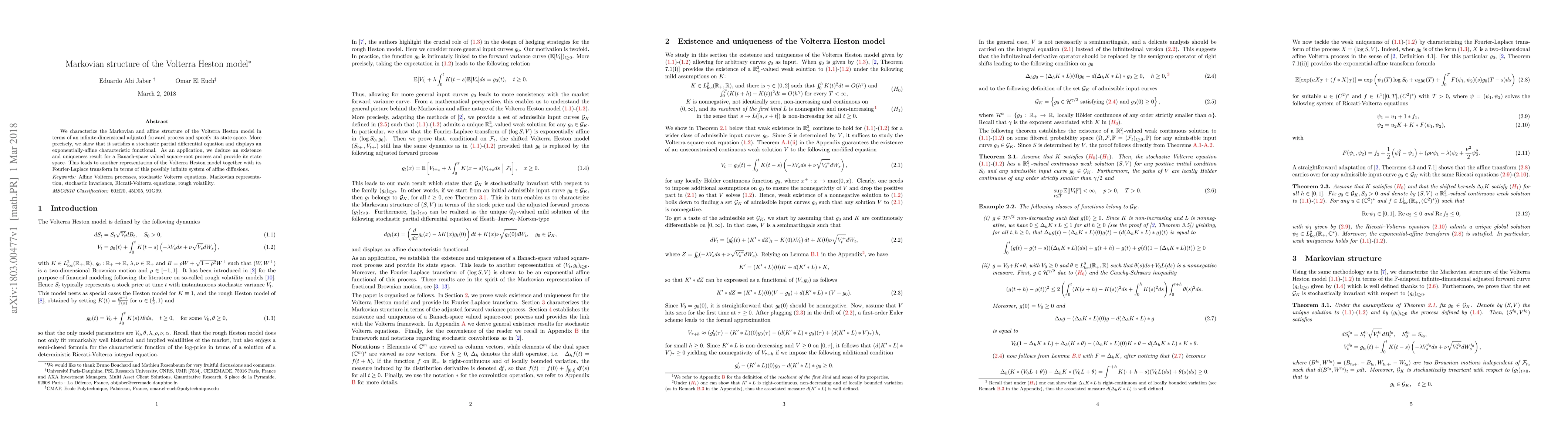

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAmerican options in the Volterra Heston model

Sergio Pulido, Etienne Chevalier, Elizabeth Zúñiga

Pricing of geometric Asian options in the Volterra-Heston model

Florian Aichinger, Sascha Desmettre

| Title | Authors | Year | Actions |

|---|

Comments (0)