Summary

Investment portfolios, central to finance, balance potential returns and risks. This paper introduces a hybrid approach combining Markowitz's portfolio theory with reinforcement learning, utilizing knowledge distillation for training agents. In particular, our proposed method, called KDD (Knowledge Distillation DDPG), consist of two training stages: supervised and reinforcement learning stages. The trained agents optimize portfolio assembly. A comparative analysis against standard financial models and AI frameworks, using metrics like returns, the Sharpe ratio, and nine evaluation indices, reveals our model's superiority. It notably achieves the highest yield and Sharpe ratio of 2.03, ensuring top profitability with the lowest risk in comparable return scenarios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

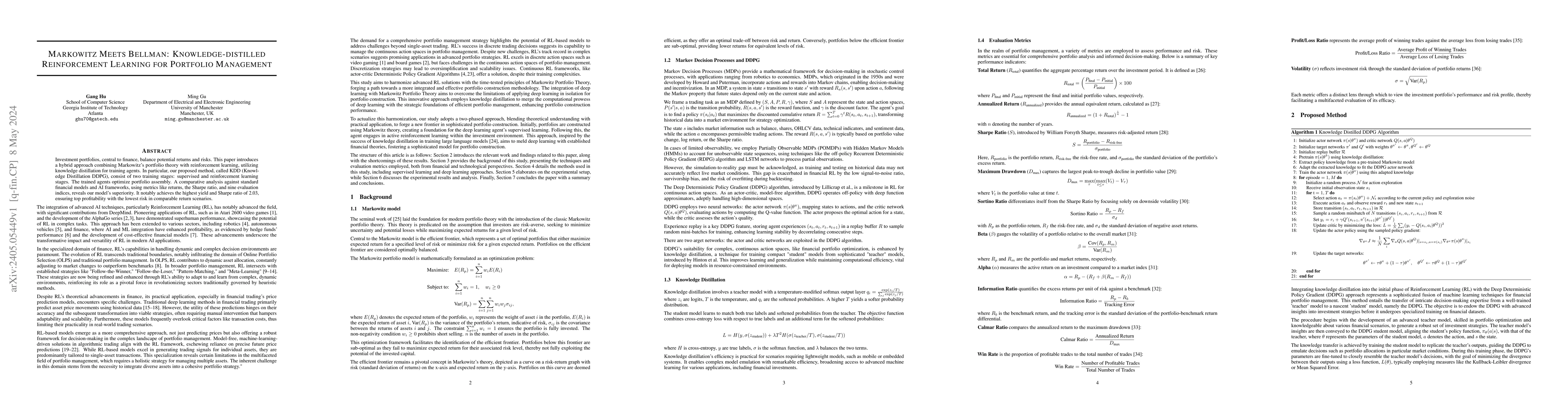

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)