Summary

We show that our generalization of the Black-Scholes partial differential equation (pde) for nontrivial diffusion coefficients is equivalent to a Martingale in the risk neutral discounted stock price. Previously, this was proven for the case of the Gaussian logarithmic returns model by Harrison and Kreps, but we prove it for much a much larger class of returns models where the diffusion coefficient depends on both returns x and time t. That option prices blow up if fat tails in logarithmic returns x are included in the market dynamics is also explained.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

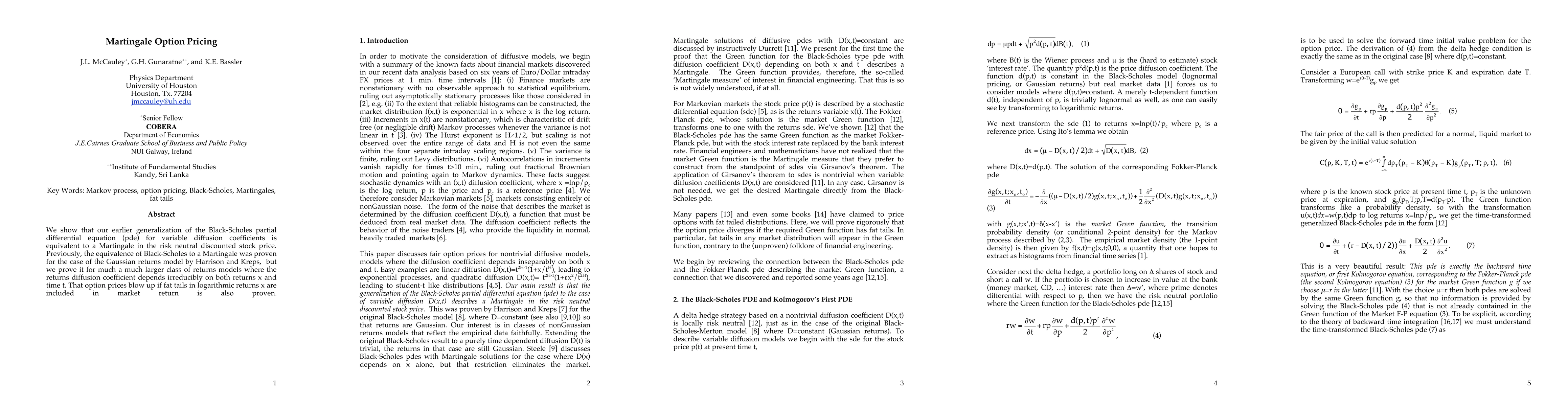

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeometry of vectorial martingale optimal transport and robust option pricing

Brendan Pass, Joshua Zoen-Git Hiew, Tongseok Lim et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)