Summary

Let X and Y be an m-dimensional F-semimartingale and an n-dimensional H-semimartingale respectively on the same probability space, both enjoying the strong predictable representation property. We propose a martingale representation result under the probability measure P for the square integrable G-martingales, where G is the union of F and H. As a first application we identify the biggest possible value of the multiplicity in the sense of Davis and Varaiya of the union of F1,..., Fd, where, fixed i in (1,...,d), Fi is the reference filtration of a real martingale Mi, which enjoys the Fi-predictable representation property. A second application falls into the framework of credit risk modeling and in particular into the study of the progressive enlargement of the market filtration by a default time. More precisely, when the risky asset price is a multidimensional semimartingale enjoying the strong predictable representation property and the default time satisfies the density hypothesis, we present a new proof of the analogous of the classical theorem of Kusuoka.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

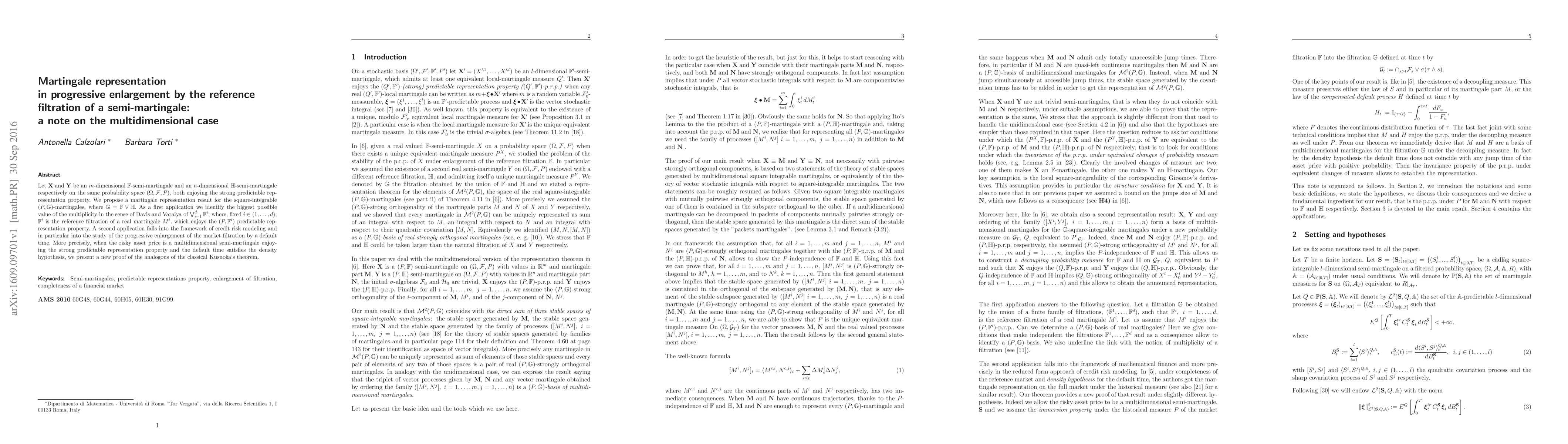

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)