Summary

We provide sharp estimates for the distribution function of a martingale transform of the indicator function of an event. They are formulated in terms of Burkholder functions, which are reduced to the already known Bellman functions for extremal problems on $\mathrm{BMO}$. The reduction implicitly uses an unexpected phenomenon of automatic concavity for those Bellman functions: their concavity in some directions implies concavity with respect to other directions. A similar question for a martingale transform of a bounded random variable is also considered.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper employs a rigorous mathematical approach, utilizing martingale transforms and Burkholder functions to derive sharp estimates for the distribution of such transforms. It reduces Burkholder functions to Bellman functions for extremal problems on BMO, exploiting an unexpected concavity phenomenon for these Bellman functions.

Key Results

- Sharp estimates for the distribution function of a martingale transform of the indicator function of an event are provided.

- Reduction of Burkholder functions to Bellman functions for extremal problems on BMO is demonstrated.

- Automatic concavity for Bellman functions is observed, implying concavity in other directions.

- Similar analysis is extended to martingale transforms of bounded random variables.

- Theorems 3.2.5 and 3.2.6 establish conditions under which functions V coincide with their martingale counterparts.

Significance

This research contributes to the understanding of martingale theory and BMO spaces, providing sharp estimates crucial for extremal problems, which have applications in probability theory and stochastic analysis.

Technical Contribution

The paper introduces a novel approach to estimating the distribution function of martingale transforms using Burkholder functions and Bellman functions, highlighting an unexpected concavity property.

Novelty

The reduction of Burkholder functions to Bellman functions and the observation of automatic concavity for Bellman functions present a novel perspective in the study of martingale transforms and extremal problems in BMO spaces.

Limitations

- The findings are specific to martingale transforms and indicator functions of events, with limited generalization to broader classes of random variables or stochastic processes.

- The proof techniques are highly technical and may not be easily accessible to non-specialists in the field.

Future Work

- Investigate the implications of the automatic concavity phenomenon for a wider class of functions and problems.

- Explore potential applications in more complex stochastic models and financial mathematics.

Paper Details

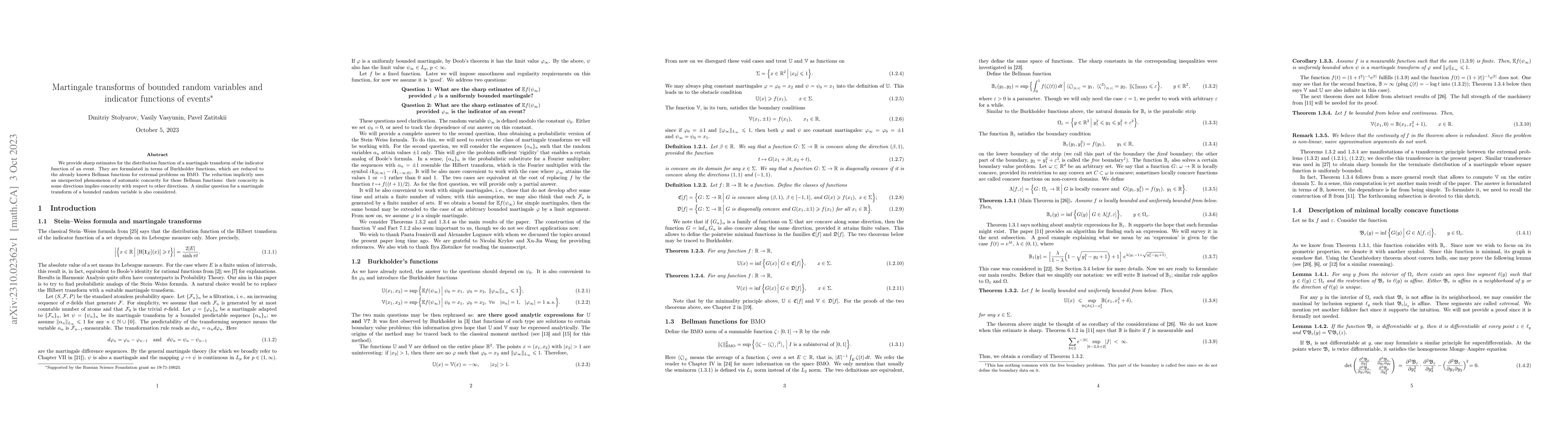

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)