Authors

Summary

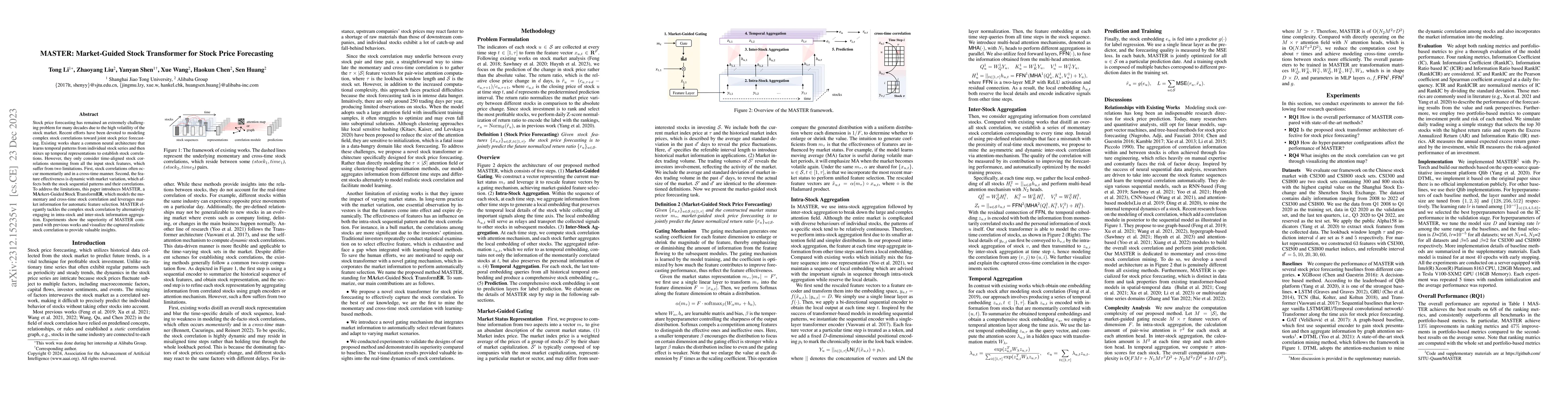

Stock price forecasting has remained an extremely challenging problem for many decades due to the high volatility of the stock market. Recent efforts have been devoted to modeling complex stock correlations toward joint stock price forecasting. Existing works share a common neural architecture that learns temporal patterns from individual stock series and then mixes up temporal representations to establish stock correlations. However, they only consider time-aligned stock correlations stemming from all the input stock features, which suffer from two limitations. First, stock correlations often occur momentarily and in a cross-time manner. Second, the feature effectiveness is dynamic with market variation, which affects both the stock sequential patterns and their correlations. To address the limitations, this paper introduces MASTER, a MArkert-Guided Stock TransformER, which models the momentary and cross-time stock correlation and leverages market information for automatic feature selection. MASTER elegantly tackles the complex stock correlation by alternatively engaging in intra-stock and inter-stock information aggregation. Experiments show the superiority of MASTER compared with previous works and visualize the captured realistic stock correlation to provide valuable insights.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHidformer: Transformer-Style Neural Network in Stock Price Forecasting

Kamil Ł. Szydłowski, Jarosław A. Chudziak

Transformer-Based Deep Learning Model for Stock Price Prediction: A Case Study on Bangladesh Stock Market

Mohammad Shafiul Alam, Muhammad Ibrahim, Tashreef Muhammad et al.

The Predictability of Stock Price: Empirical Study onTick Data in Chinese Stock Market

Tian Lan, Xingyu Xu, Sihai Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)