Summary

We study two-sided many-to-one matching markets with transferable utilities, e.g., labor and rental housing markets, in which money can exchange hands between agents, subject to distributional constraints on the set of feasible allocations. In such markets, we establish the efficiency of equilibrium arrangements, specified by an assignment and transfers between agents on the two sides of the market, and study the conditions on the distributional constraints and agent preferences under which equilibria exist and can be computed efficiently. To this end, we first consider the setting when the number of institutions (e.g., firms in a labor market) is one and show that equilibrium arrangements exist irrespective of the nature of the constraint structure or the agents' preferences. However, equilibrium arrangements may not exist in markets with multiple institutions even when agents on each side have linear (or additively separable) preferences over agents on the other side. Thus, for markets with linear preferences, we study sufficient conditions on the constraint structure that guarantee the existence of equilibria using linear programming duality. Our linear programming approach not only generalizes that of Shapley and Shubik (1971) in the one-to-one matching setting to the many-to-one matching setting under distributional constraints but also provides a method to compute market equilibria efficiently.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

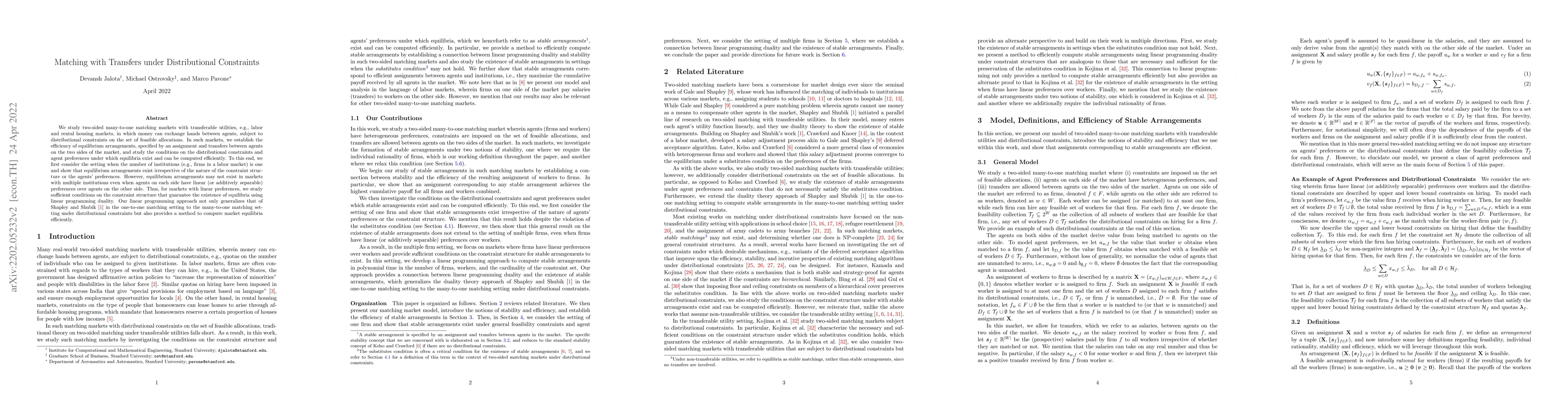

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCutoff stability under distributional constraints with an application to summer internship matching

Haris Aziz, Anton Baychkov, Peter Biro

| Title | Authors | Year | Actions |

|---|

Comments (0)