Summary

We introduce matrix H theory, a framework for analyzing collective behavior arising from multivariate stochastic processes with hierarchical structure. The theory models the joint distribution of the multiple variables (the measured signal) as a compound of a large-scale multivariate distribution with the distribution of a slowly fluctuating background. The background is characterized by a hierarchical stochastic evolution of internal degrees of freedom, representing the correlations between stocks at different time scales. As in its univariate version, the matrix H-theory formalism also has two universality classes: Wishart and inverse Wishart, enabling a concise description of both the background and the signal probability distributions in terms of Meijer G-functions with matrix argument. Empirical analysis of daily returns of stocks within the S&P500 demonstrates the effectiveness of matrix H theory in describing fluctuations in stock markets. These findings contribute to a deeper understanding of multivariate hierarchical processes and offer potential for developing more informed portfolio strategies in financial markets.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper introduces matrix H-theory, a framework for analyzing multivariate stochastic processes with hierarchical structure, using Meijer G-functions with matrix argument to describe background and signal distributions.

Key Results

- Matrix H-theory effectively describes fluctuations in stock markets using empirical analysis of daily returns of S&P500 stocks.

- Two universality classes, Wishart and inverse Wishart, are identified for characterizing the background and signal probability distributions.

- The theory identifies the Wishart universality class as the most appropriate description for non-Gaussian behavior in financial markets.

- The presence of multiple timescales in financial markets is linked to investor horizons and strategies, with estimates suggesting timescales of one week, one month, and one quarter for the U.S. stock market.

Significance

This research contributes to a deeper understanding of multivariate hierarchical processes, offering potential for developing more informed portfolio strategies in financial markets by accurately capturing non-Gaussian behavior and multiple timescales.

Technical Contribution

The matrix extension of H-theory (MHT) provides a systematic approach to extract the number of scales from multivariate stochastic processes, categorizing them into two universality classes: Wishart and inverse Wishart.

Novelty

The MHT extends the applicability of H-theory to more complex systems by generalizing Meijer G-functions to function of matrix argument and applying CFT theorems, justifying the use of aggregated distributions in the analysis.

Limitations

- The study is limited to S&P500 stock returns over a 14-year period (2010-2024).

- The analysis assumes that the covariance matrix evolves as a random matrix process, which might not hold in all market conditions.

- The findings are based on normalized returns, which might not capture all aspects of real-world trading dynamics.

Future Work

- Investigate the applicability of the H-theory formalism to other stock indexes and longer time periods.

- Explore the impact of different market conditions (e.g., crises, high volatility periods) on the identified timescales and universality classes.

- Extend the analysis to include other financial assets and markets to assess the generalizability of the findings.

Paper Details

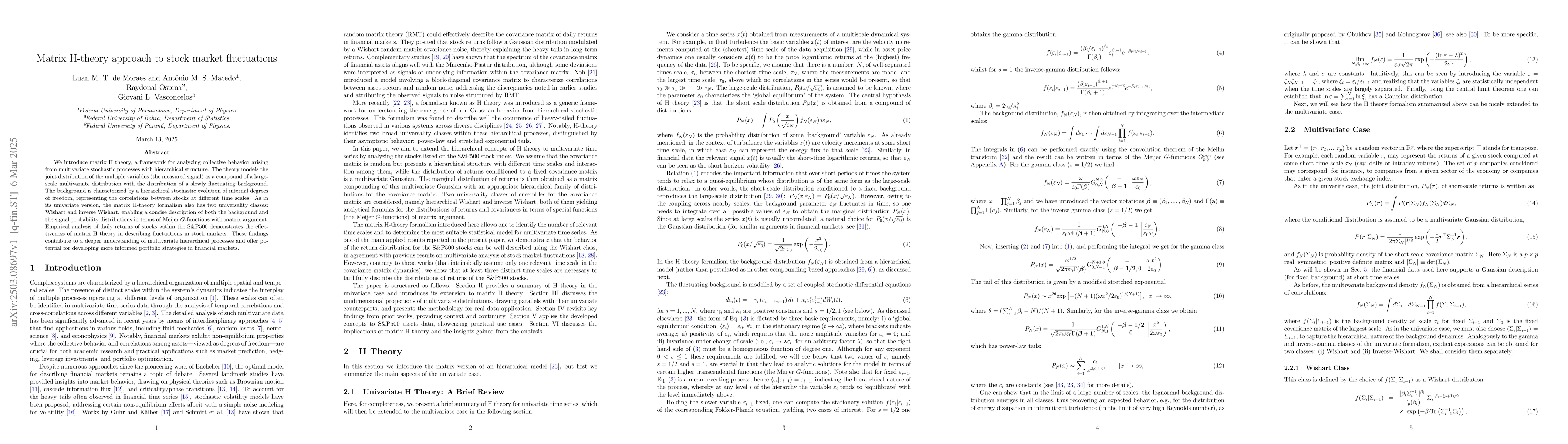

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)