Summary

This paper investigates the problem of maximizing expected terminal utility in a (generically incomplete) discrete-time financial market model with finite time horizon. In contrast to the standard setting, a possibly non-concave utility function $U$ is considered, with domain of definition $\mathbb{R}$. Simple conditions are presented which guarantee the existence of an optimal strategy for the problem. In particular, the asymptotic elasticity of $U$ plays a decisive role: existence can be shown when it is strictly greater at $-\infty$ than at $+\infty$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

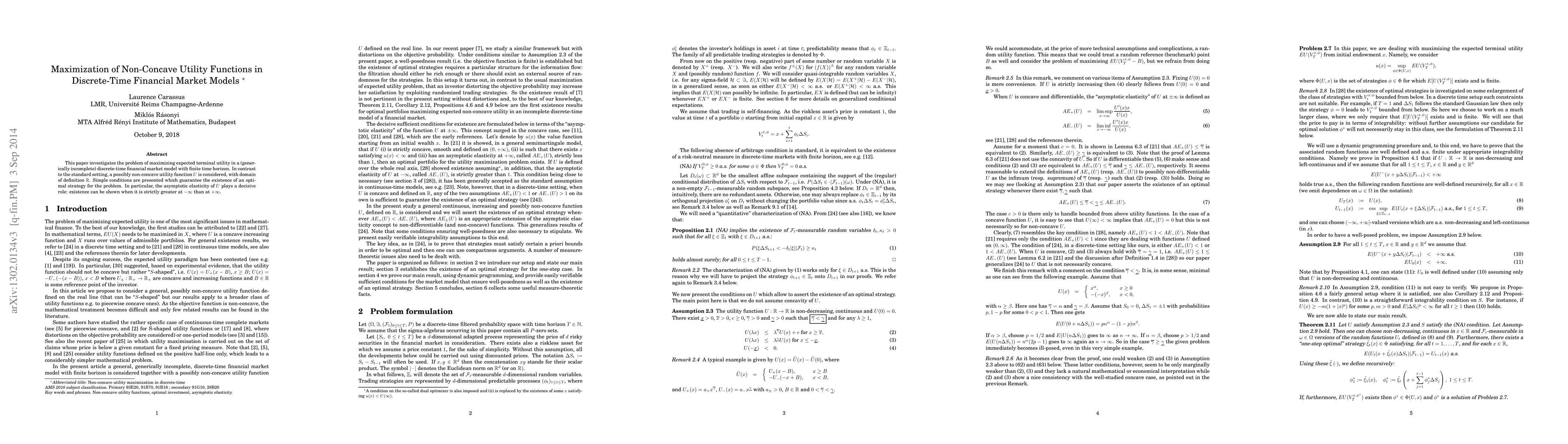

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)