Summary

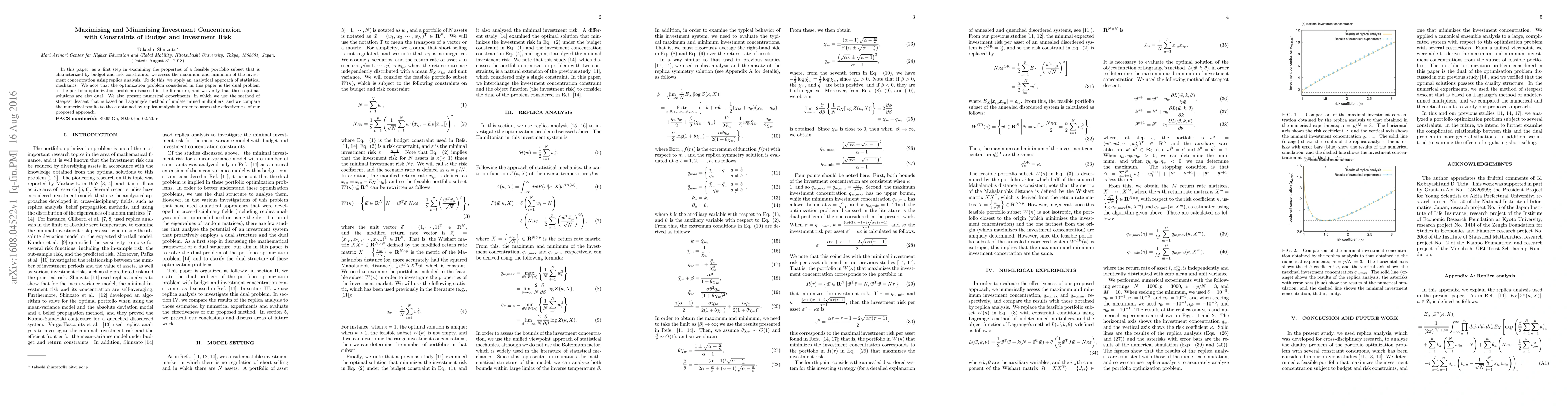

In this paper, as a first step in examining the properties of a feasible portfolio subset that is characterized by budget and risk constraints, we assess the maximum and minimum of the investment concentration using replica analysis. To do this, we apply an analytical approach of statistical mechanics. We note that the optimization problem considered in this paper is the dual problem of the portfolio optimization problem discussed in the literature, and we verify that these optimal solutions are also dual. We also present numerical experiments, in which we use the method of steepest descent that is based on Lagrange's method of undetermined multipliers, and we compare the numerical results to those obtained by replica analysis in order to assess the effectiveness of our proposed approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)