Authors

Summary

Transaction fee mechanism design is a new decentralized mechanism design problem where users bid for space on the blockchain. Several recent works showed that the transaction fee mechanism design fundamentally departs from classical mechanism design. They then systematically explored the mathematical landscape of this new decentralized mechanism design problem in two settings: in the plain setting where no cryptography is employed, and in a cryptography-assisted setting where the rules of the mechanism are enforced by a multi-party computation protocol. Unfortunately, in both settings, prior works showed that if we want the mechanism to incentivize honest behavior for both users as well as miners (possibly colluding with users), then the miner revenue has to be zero. Although adopting a relaxed, approximate notion of incentive compatibility gets around this zero miner-revenue limitation, the scaling of the miner revenue is nonetheless poor. In this paper, we show that if we make a mildly stronger reasonable-world assumption than prior works, we can circumvent the known limitations on miner revenue, and design auctions that generate optimal miner revenue. We also systematically explore the mathematical landscape of transaction fee mechanism design under the new reasonable-world and demonstrate how such assumptions can alter the feasibility and infeasibility landscape.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

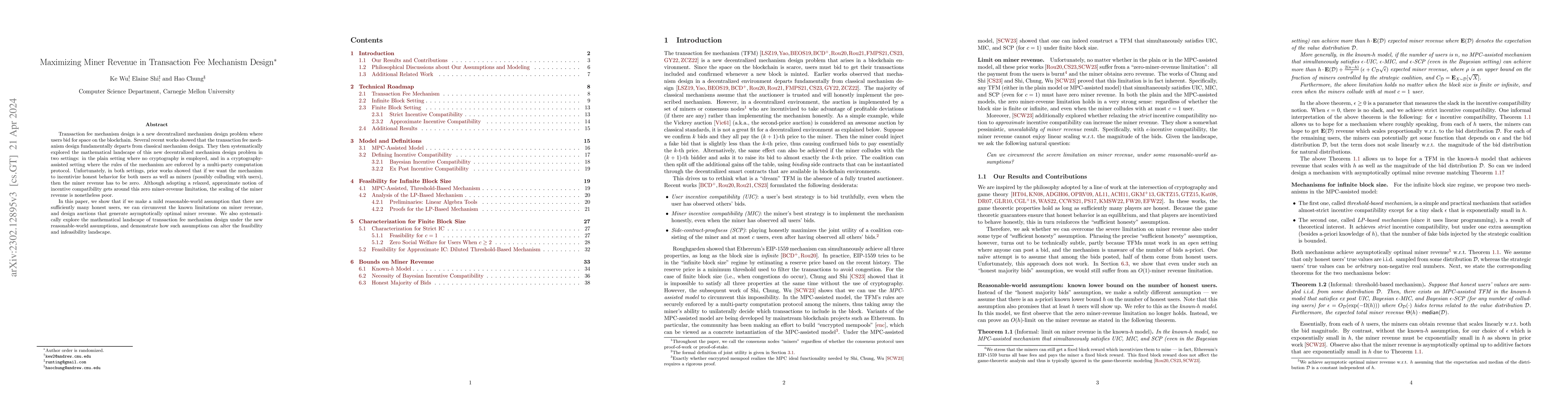

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Mechanism Design for Blockchain Transaction Fee Allocation

Xi Chen, David Simchi-Levi, Yuan Zhou et al.

Revisiting the Primitives of Transaction Fee Mechanism Design

Aadityan Ganesh, S. Matthew Weinberg, Clayton Thomas

| Title | Authors | Year | Actions |

|---|

Comments (0)