Summary

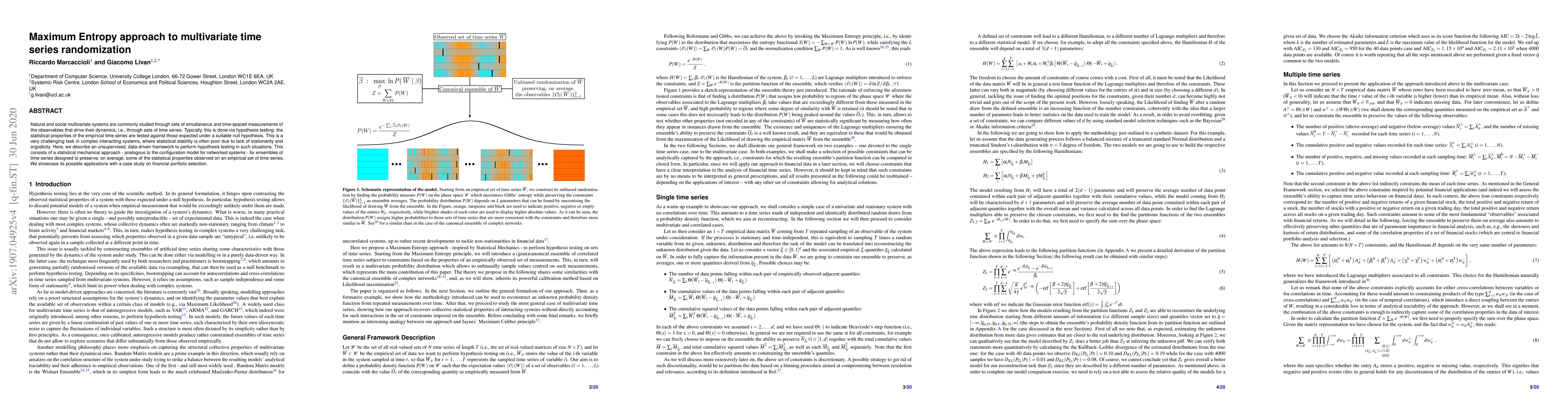

Natural and social multivariate systems are commonly studied through sets of simultaneous and time-spaced measurements of the observables that drive their dynamics, i.e., through sets of time series. Typically, this is done via hypothesis testing: the statistical properties of the empirical time series are tested against those expected under a suitable null hypothesis. This is a very challenging task in complex interacting systems, where statistical stability is often poor due to lack of stationarity and ergodicity. Here, we describe an unsupervised, data-driven framework to perform hypothesis testing in such situations. This consists of a statistical mechanical approach - analogous to the configuration model for networked systems - for ensembles of time series designed to preserve, on average, some of the statistical properties observed on an empirical set of time series. We showcase its possible applications with a case study on financial portfolio selection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEntropy Causal Graphs for Multivariate Time Series Anomaly Detection

Chandra Thapa, Feng Xia, Kristen Moore et al.

A Pattern Discovery Approach to Multivariate Time Series Forecasting

Chenjuan Guo, Bin Yang, Kai Zheng et al.

No citations found for this paper.

Comments (0)