Authors

Summary

Maximum likelihood estimation is a common method of estimating the parameters of the probability distribution from a given sample. This paper aims to introduce the maximum likelihood estimation in the framework of sublinear expectation. We find the maximum likelihood estimator for the parameters of the maximal distribution via the solution of the associated minimax problem, which coincides with the optimal unbiased estimation given by Jin and Peng \cite{JP21}. A general estimation method for samples with dependent structure is also provided. This result provides a theoretical foundation for the estimator of upper and lower variances, which is widely used in the G-VaR prediction model in finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

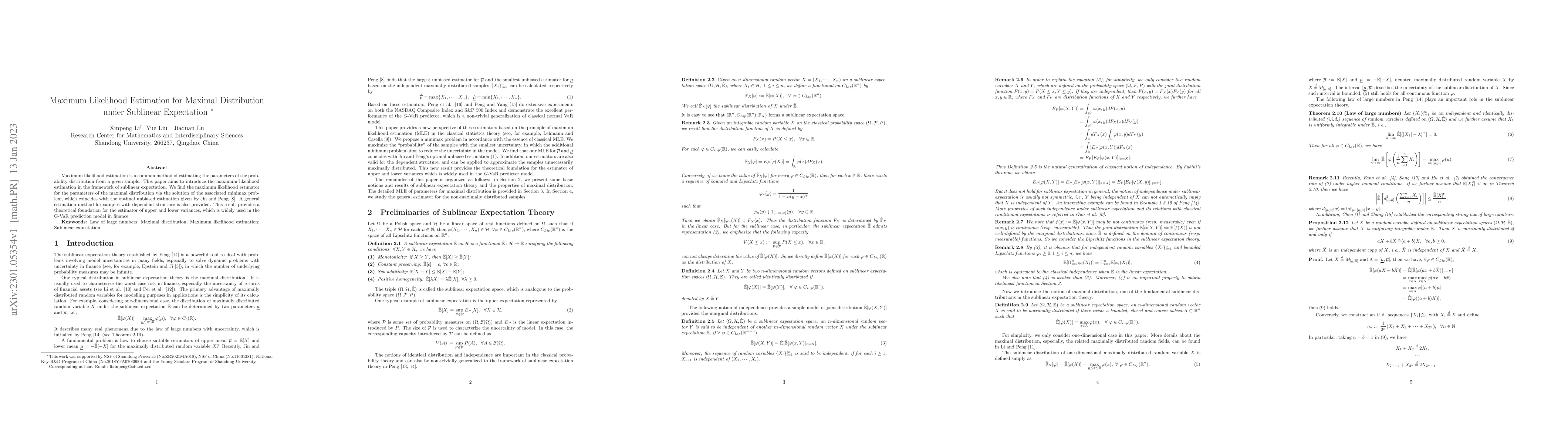

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)