Authors

Summary

In this paper, we study a stochastic optimal control problem under a type of consistent convex expectation dominated by G-expectation. By the separation theorem for convex sets, we get the representation theorems for this convex expectation and conditional convex expectation. Based on these results, we obtain the variational equation for cost functional by weak convergence and discretization methods. Furthermore, we establish the maximum principle which is sufficient under usual convex assumptions. Finally, we study the linear quadratic control problem by using the obtained maximum principle.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

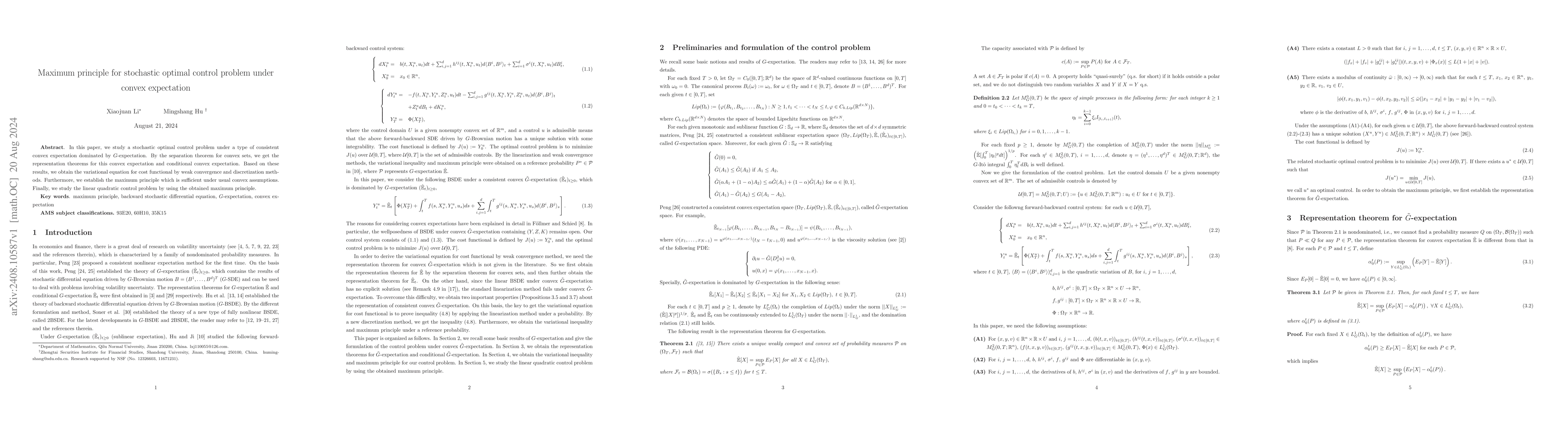

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMaximum principle for discrete-time stochastic optimal control problem under distribution uncertainty

Shaolin Ji, Mingshang Hu, Xiaojuan Li

Dynamic programming principle for stochastic optimal control problem under degenerate G-expectation

Xiaojuan Li

| Title | Authors | Year | Actions |

|---|

Comments (0)