Summary

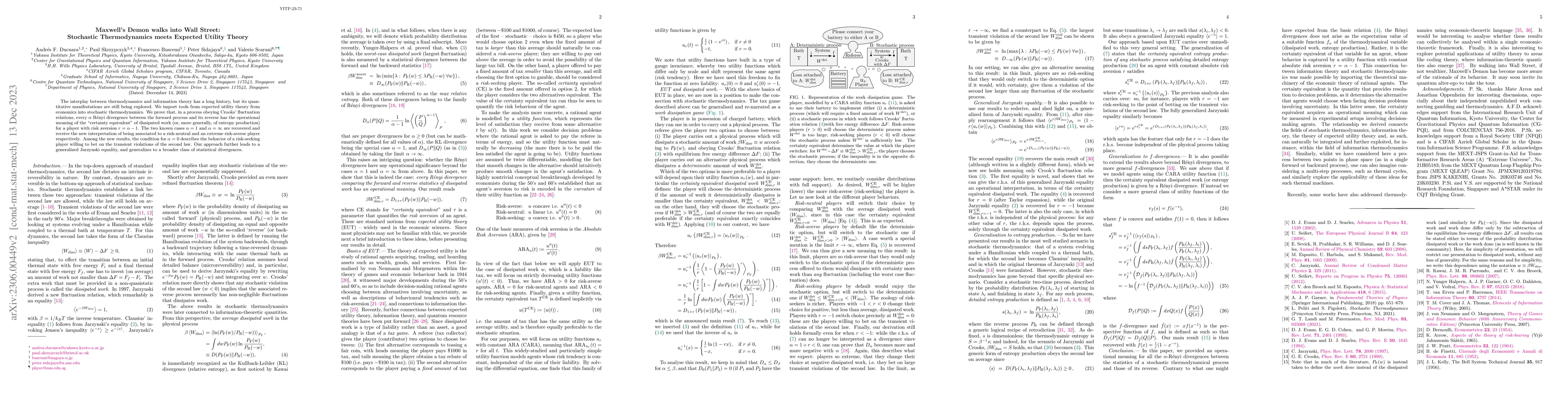

The interplay between thermodynamics and information theory has a long history, but its quantitative manifestations are still being explored. We import tools from expected utility theory from economics into stochastic thermodynamics. We prove that, in a process obeying Crooks' fluctuation relations, every $\alpha$ R\'enyi divergence between the forward process and its reverse has the operational meaning of the ``certainty equivalent'' of dissipated work (or, more generally, of entropy production) for a player with risk aversion $r=\alpha-1$. The two known cases $\alpha=1$ and $\alpha=\infty$ are recovered and receive the new interpretation of being associated to a risk-neutral and an extreme risk-averse player respectively. Among the new results, the condition for $\alpha=0$ describes the behavior of a risk-seeking player willing to bet on the transient violations of the second law. Our approach further leads to a generalized Jarzynski equality, and generalizes to a broader class of statistical divergences.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)