Summary

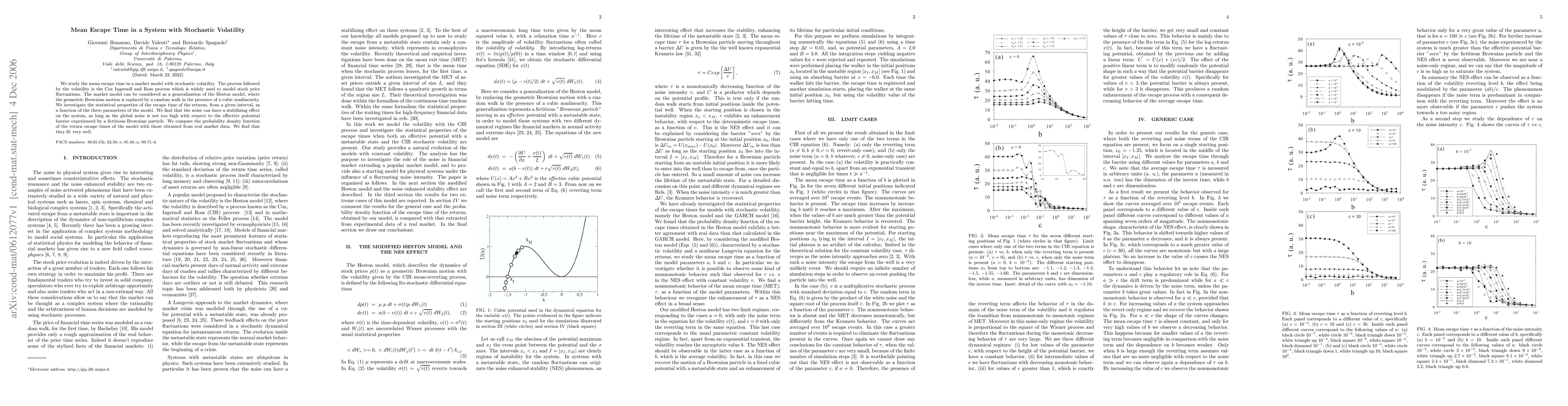

We study the mean escape time in a market model with stochastic volatility. The process followed by the volatility is the Cox Ingersoll and Ross process which is widely used to model stock price fluctuations. The market model can be considered as a generalization of the Heston model, where the geometric Brownian motion is replaced by a random walk in the presence of a cubic nonlinearity. We investigate the statistical properties of the escape time of the returns, from a given interval, as a function of the three parameters of the model. We find that the noise can have a stabilizing effect on the system, as long as the global noise is not too high with respect to the effective potential barrier experienced by a fictitious Brownian particle. We compare the probability density function of the return escape times of the model with those obtained from real market data. We find that they fit very well.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic Volatility-in-mean VARs with Time-Varying Skewness

Leonardo N. Ferreira, Haroon Mumtaz, Ana Skoblar

| Title | Authors | Year | Actions |

|---|

Comments (0)