Summary

By analysing the financial data of firms across Japan, a nonlinear power law with an exponent of 1.3 was observed between the number of business partners (i.e. the degree of the inter-firm trading network) and sales. In a previous study using numerical simulations, we found that this scaling can be explained by both the money-transport model, where a firm (i.e. customer) distributes money to its out-edges (suppliers) in proportion to the in-degree of destinations, and by the correlations among the Japanese inter-firm trading network. However, in this previous study, we could not specifically identify what types of structure properties (or correlations) of the network determine the 1.3 exponent. In the present study, we more clearly elucidate the relationship between this nonlinear scaling and the network structure by applying mean-field approximation of the diffusion in a complex network to this money-transport model. Using theoretical analysis, we obtained the mean-field solution of the model and found that, in the case of the Japanese firms, the scaling exponent of 1.3 can be determined from the power law of the average degree of the nearest neighbours of the network with an exponent of -0.7.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

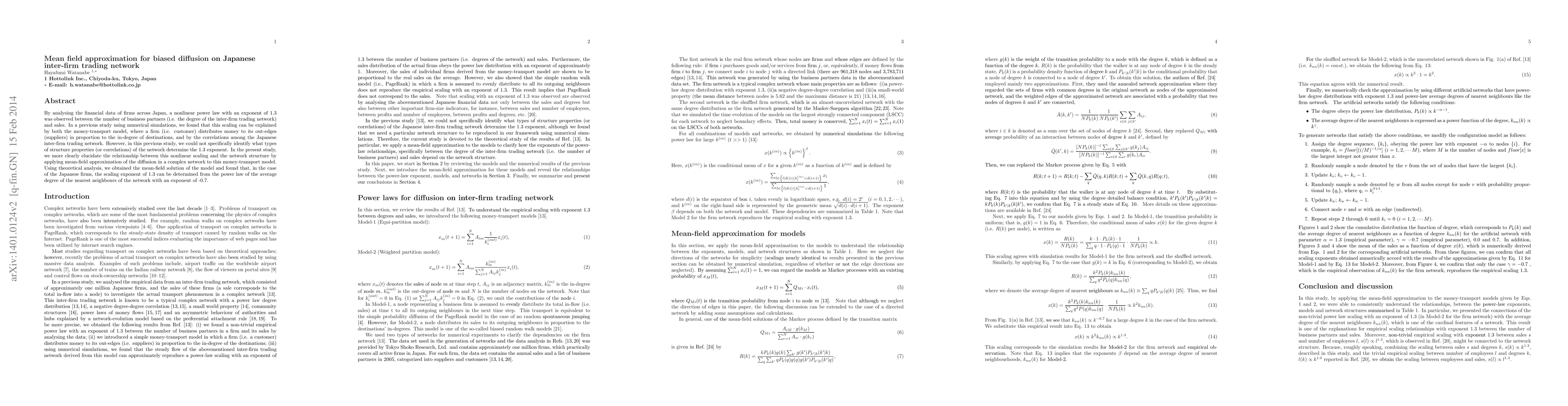

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)