Summary

In this paper we study the mean-field backward stochastic differential equations (mean-field bsde) of the form dY(t) =-f(t,Y(t),Z(t),K(t, . ),E[\varphi(Y(t),Z(t),K(t,.))])dt+Z(t)dB(t) +\int_{R_{0}}K(t,\zeta)\tilde{N}(dt,d\zeta), where B is a Brownian motion, \tilde{N} is the compensated Poisson random measure. Under some mild conditions, we prove the existence and uniqueness of the solution triplet (Y,Z,K). It is commonly believed that there is no comparison theorem for general mean-field bsde. However, we prove a comparison theorem for a subclass of these equations. When the mean-field bsde is linear, we give an explicit formula for the first component Y(t) of the solution triplet. Our results are applied to solve a mean-field recursive utility optimization problem in finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

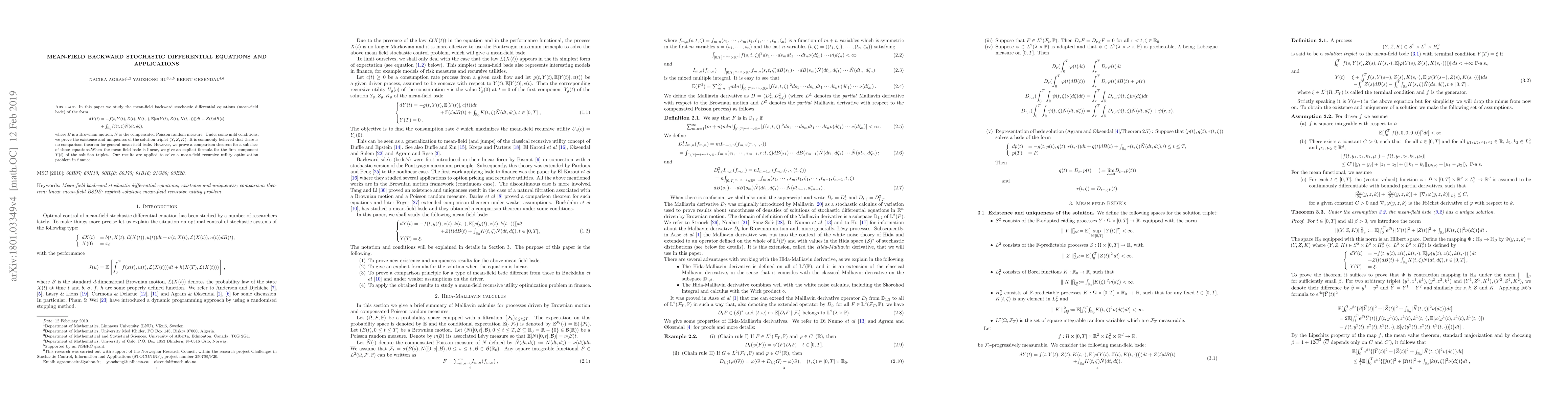

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)