Summary

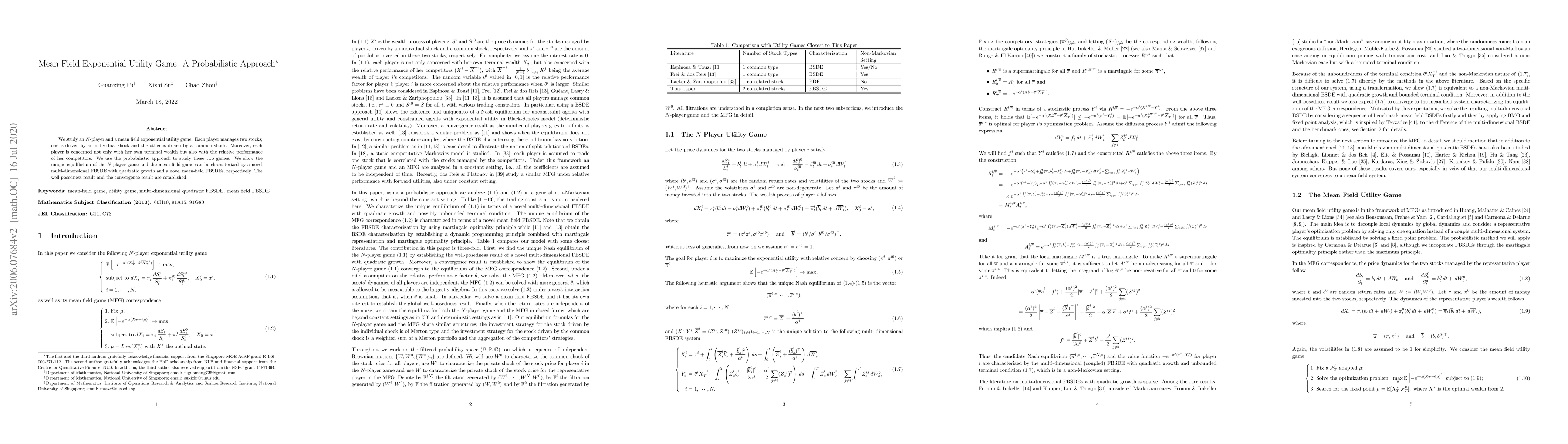

We study an $N$-player and a mean field exponential utility game. Each player manages two stocks; one is driven by an individual shock and the other is driven by a common shock. Moreover, each player is concerned not only with her own terminal wealth but also with the relative performance of her competitors. We use the probabilistic approach to study these two games. We show the unique equilibrium of the $N$-player game and the mean field game can be characterized by a novel multi-dimensional FBSDE with quadratic growth and a novel mean-field FBSDEs, respectively. The well-posedness result and the convergence result are established.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMean-field equilibrium price formation with exponential utility

Masaaki Fujii, Masashi Sekine

| Title | Authors | Year | Actions |

|---|

Comments (0)