Authors

Summary

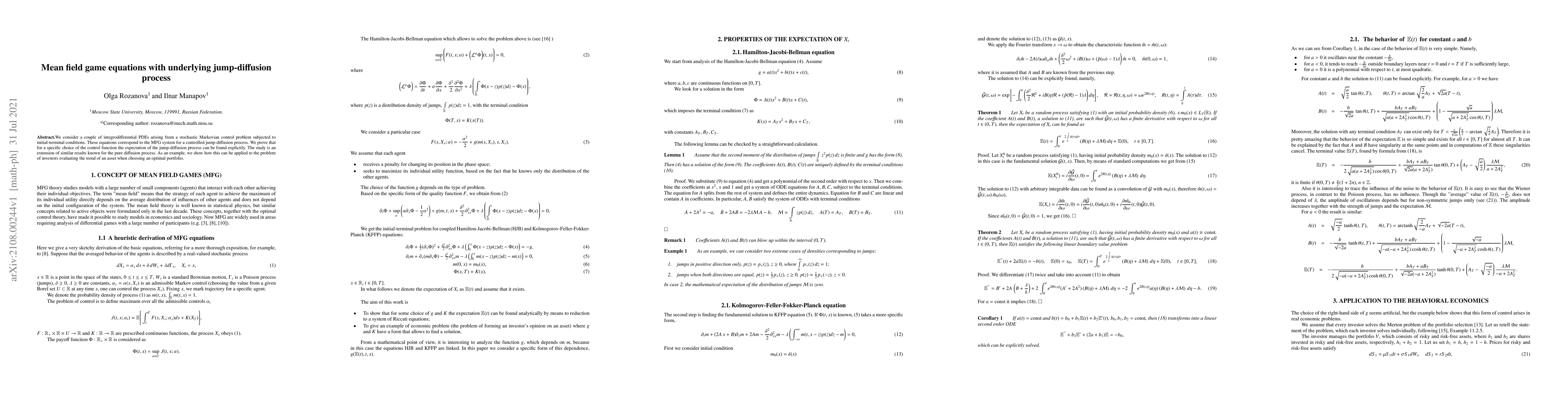

We consider a couple of integrodifferential PDEs arising from a stochastic Markovian control problem subjected to initial-terminal conditions. These equations correspond to the MFG system for a controlled jump-diffusion process. We prove that for a specific choice of the control function the expectation of the jump-diffusion process can be found explicitly. The study is an extension of similar results known for the pure diffusion process. As an example, we show how this can be applied to the problem of investors evaluating the trend of an asset when choosing an optimal portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMean Field Game of Optimal Relative Investment with Jump Risk

Xiang Yu, Lijun Bo, Shihua Wang

Properties of moments of density for nonlocal mean field game equations with a quadratic cost function

Olga S. Rozanova, Mikhail V. Inyakin

| Title | Authors | Year | Actions |

|---|

Comments (0)