Summary

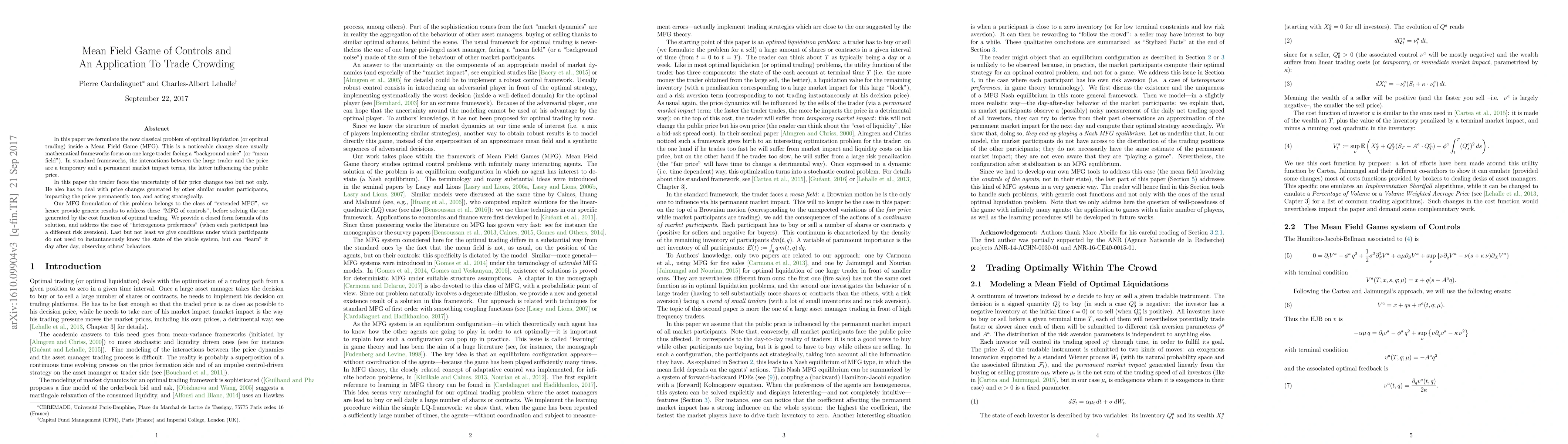

In this paper we formulate the now classical problem of optimal liquidation (or optimal trading) inside a Mean Field Game (MFG). This is a noticeable change since usually mathematical frameworks focus on one large trader in front of a "background noise" (or "mean field"). In standard frameworks, the interactions between the large trader and the price are a temporary and a permanent market impact terms, the latter influencing the public price. In this paper the trader faces the uncertainty of fair price changes too but not only. He has to deal with price changes generated by other similar market participants, impacting the prices permanently too, and acting strategically. Our MFG formulation of this problem belongs to the class of "extended MFG", we hence provide generic results to address these "MFG of controls", before solving the one generated by the cost function of optimal trading. We provide a closed form formula of its solution, and address the case of "heterogenous preferences" (when each participant has a different risk aversion). Last but not least we give conditions under which participants do not need to instantaneously know the state of the whole system, but can "learn" it day after day, observing others' behaviors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExistence of Optimal Stationary Singular Controls and Mean Field Game Equilibria

Asaf Cohen, Chuhao Sun

Mean Field Game of Controls with State Reflections: Existence and Limit Theory

Xiang Yu, Lijun Bo, Jingfei Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)