Authors

Summary

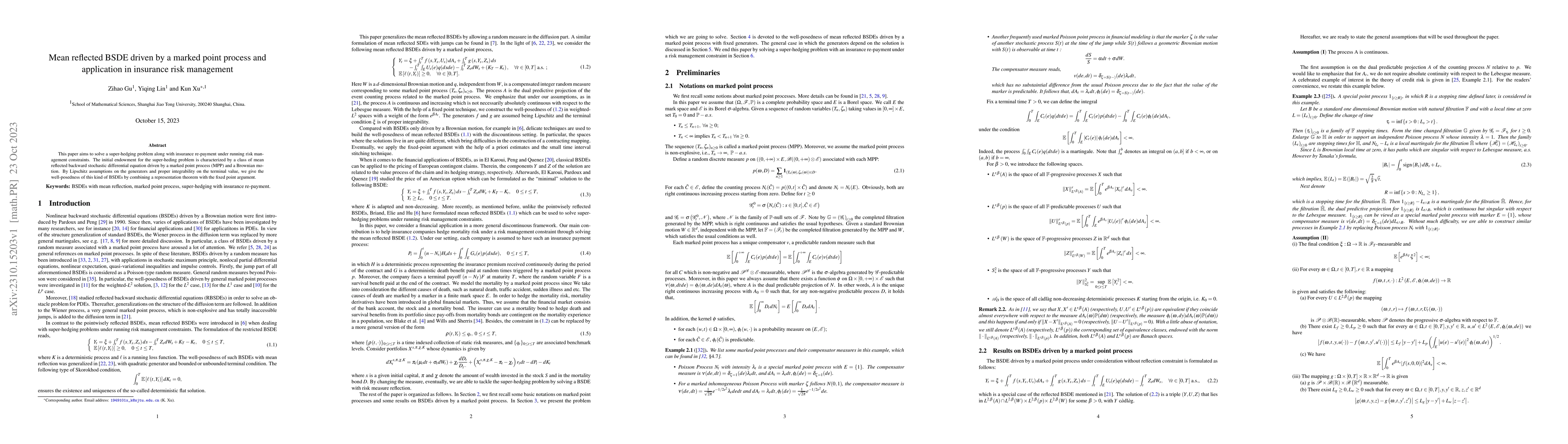

This paper aims to solve a super-hedging problem along with insurance re-payment under running risk management constraints. The initial endowment for the super-heding problem is characterized by a class of mean reflected backward stochastic differential equation driven by a marked point process (MPP) and a Brownian motion. By Lipschitz assumptions on the generators and proper integrability on the terminal value, we give the well-posedness of this kind of BSDEs by combining a representation theorem with the fixed point argument.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReflected BSDE driven by a marked point process with a convex/concave generator

Kun Xu, Yiqing Lin, Zihao Gu

Exponential growth BSDE driven by a marked point process

Kun Xu, Yiqing Lin, Zihao Gu

No citations found for this paper.

Comments (0)