Summary

In this paper, we consider the asset-liability management under the mean-variance criterion. The financial market consists of a risk-free bond and a stock whose price process is modeled by a geometric Brownian motion. The liability of the investor is uncontrollable and is modeled by another geometric Brownian motion. We consider a specific state-dependent risk aversion which depends on a power function of the liability. By solving a flow of FBSDEs with bivariate state process, we obtain the equilibrium strategy among all the open-loop controls for this time-inconsistent control problem. It shows that the equilibrium strategy is a feedback control of the liability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

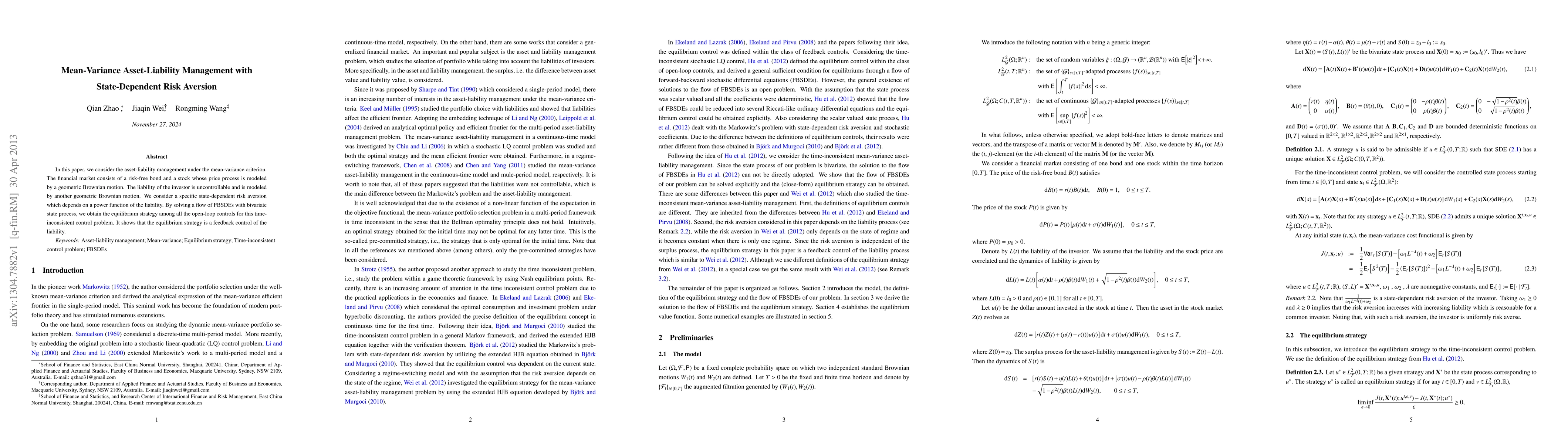

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)