Summary

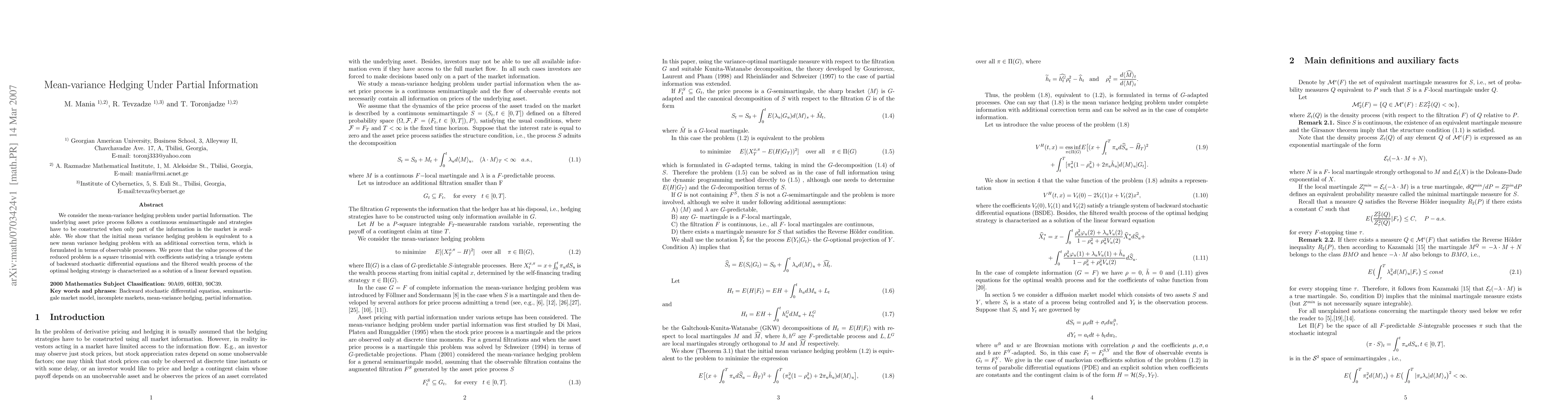

We consider the mean-variance hedging problem under partial Information. The underlying asset price process follows a continuous semimartingale and strategies have to be constructed when only part of the information in the market is available. We show that the initial mean variance hedging problem is equivalent to a new mean variance hedging problem with an additional correction term, which is formulated in terms of observable processes. We prove that the value process of the reduced problem is a square trinomial with coefficients satisfying a triangle system of backward stochastic differential equations and the filtered wealth process of the optimal hedging strategy is characterized as a solution of a linear forward equation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)