Summary

We consider an optimal investment and risk control problem for an insurer under the mean-variance (MV) criterion. By introducing a deterministic auxiliary process defined forward in time, we formulate an alternative time-consistent problem related to the original MV problem, and obtain the optimal strategy and the value function to the new problem in closed-form. We compare our formulation and optimal strategy to those under the precommitment and game-theoretic framework. Numerical studies show that, when the financial market is negatively correlated with the risk process, optimal investment may involve short selling the risky asset and, if that happens, a less risk averse insurer short sells more risky asset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

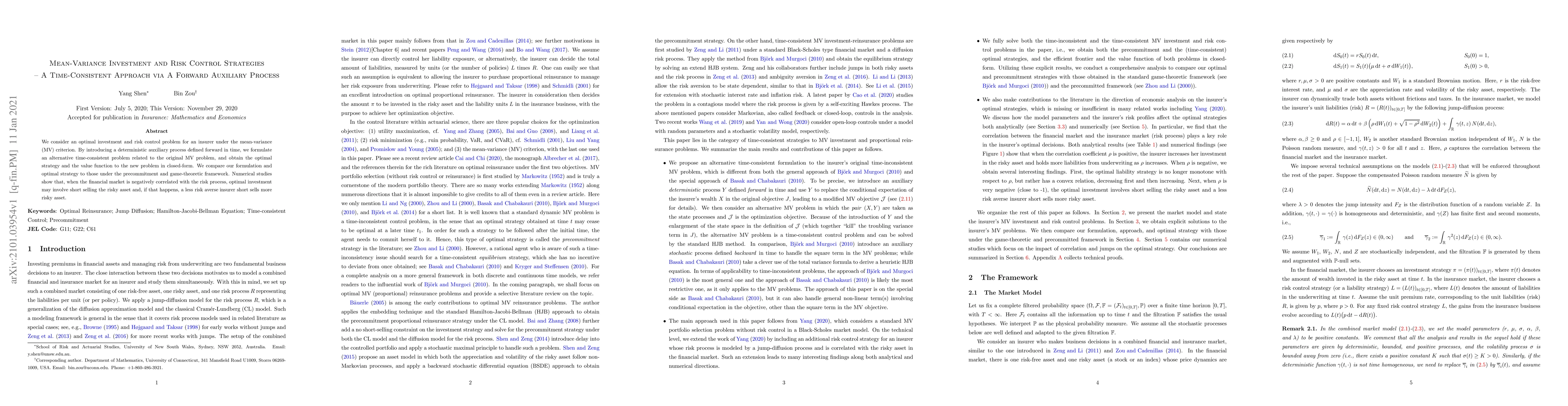

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust forward investment and consumption under drift and volatility uncertainties: A randomization approach

Gechun Liang, Wing Fung Chong

| Title | Authors | Year | Actions |

|---|

Comments (0)