Summary

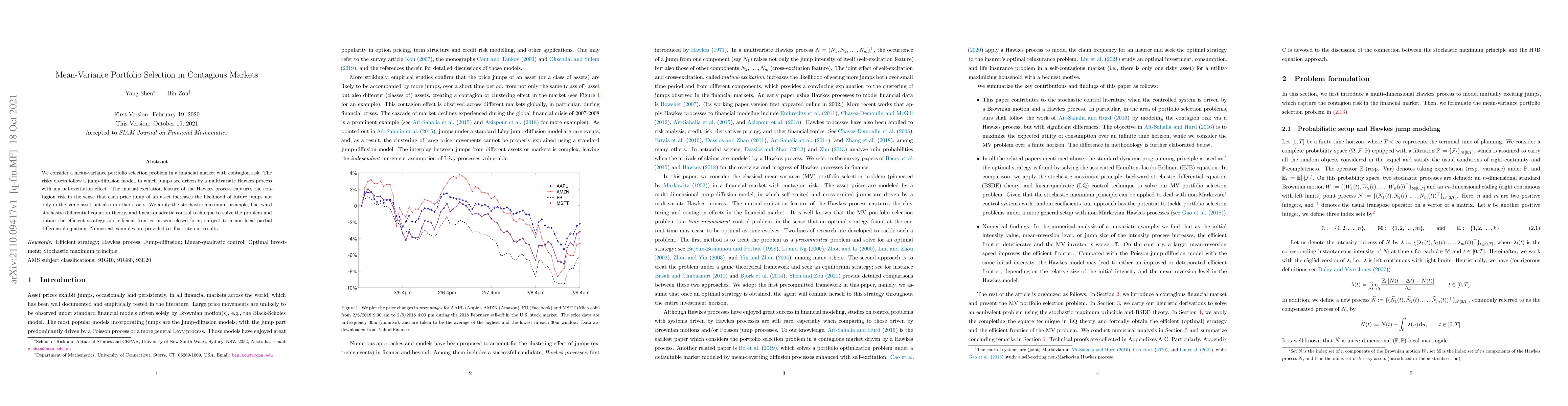

We consider a mean-variance portfolio selection problem in a financial market with contagion risk. The risky assets follow a jump-diffusion model, in which jumps are driven by a multivariate Hawkes process with mutual-excitation effect. The mutual-excitation feature of the Hawkes process captures the contagion risk in the sense that each price jump of an asset increases the likelihood of future jumps not only in the same asset but also in other assets. We apply the stochastic maximum principle, backward stochastic differential equation theory, and linear-quadratic control technique to solve the problem and obtain the efficient strategy and efficient frontier in semi-closed form, subject to a non-local partial differential equation. Numerical examples are provided to illustrate our results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMonotone Mean-Variance Portfolio Selection in Semimartingale Markets: Martingale Method

Yuchen Li, Zongxia Liang, Shunzhi Pang

The Exploratory Multi-Asset Mean-Variance Portfolio Selection using Reinforcement Learning

Yu Li, Yuhan Wu, Shuhua Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)