Summary

Motivated by applications arising in networked systems, this work examines controlled regime-switching systems that stem from a mean-variance formulation. A main point is that the switching process is a hidden Markov chain. An additional piece of information, namely, a noisy observation of switching process corrupted by white noise is available. We focus on minimizing the variance subject to a fixed terminal expectation. Using the Wonham filter, we convert the partially observed system to a completely observable one first. Since closed-form solutions are virtually impossible be obtained, a Markov chain approximation method is used to devise a computational scheme. Convergence of the algorithm is obtained. A numerical example is provided to demonstrate the results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

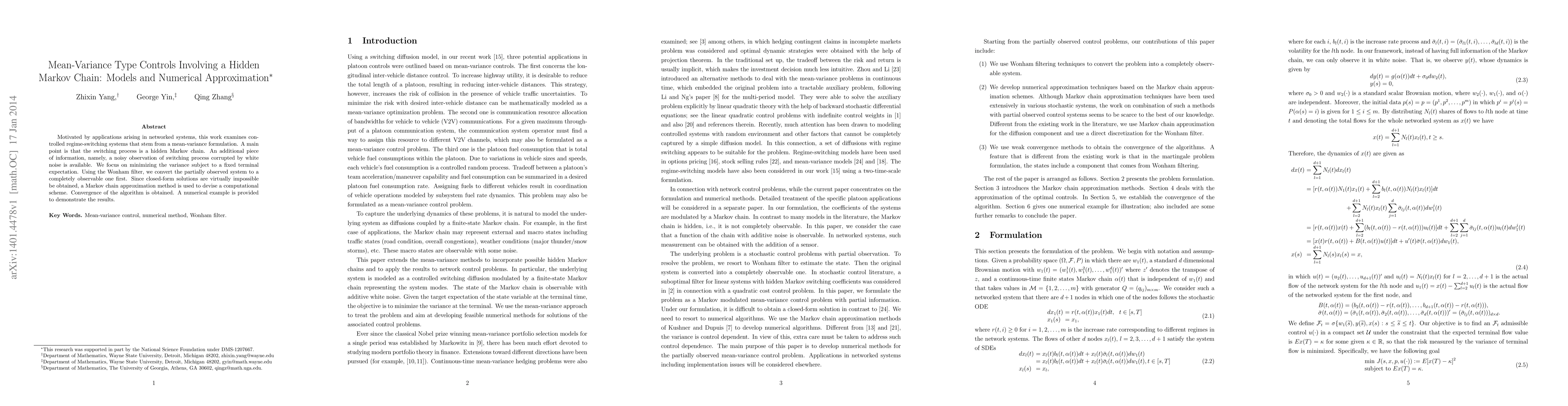

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMarkov Chain Variance Estimation: A Stochastic Approximation Approach

Siva Theja Maguluri, Prashanth L. A., Shubhada Agrawal

Mean-variance portfolio selection with dynamic attention behavior in a hidden Markov model

Y. Zhang, Z. Jin, J. Wei et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)