Summary

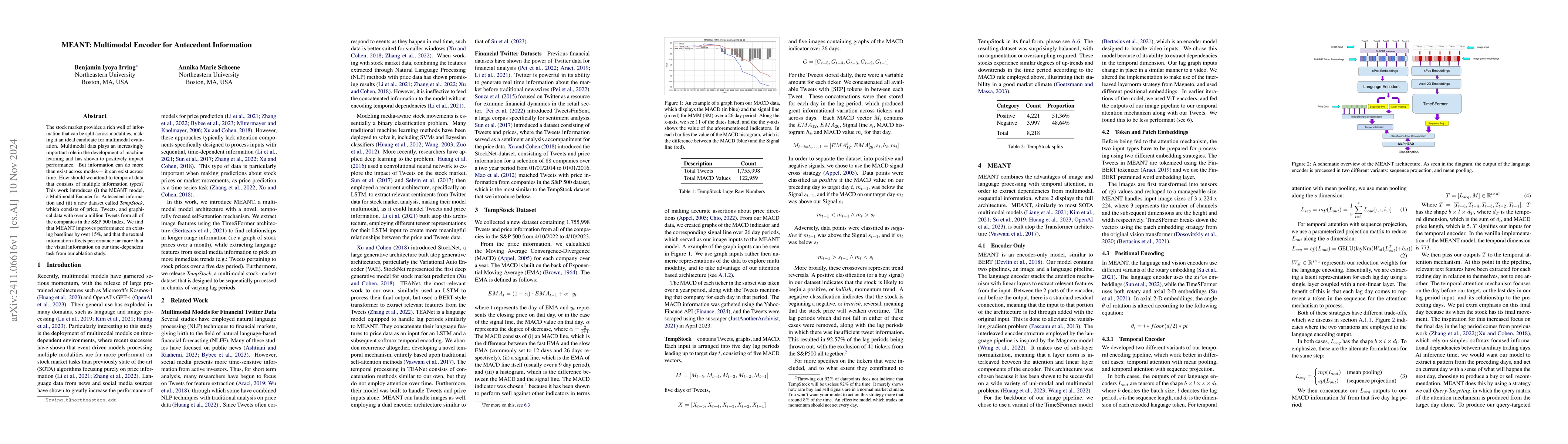

The stock market provides a rich well of information that can be split across modalities, making it an ideal candidate for multimodal evaluation. Multimodal data plays an increasingly important role in the development of machine learning and has shown to positively impact performance. But information can do more than exist across modes -- it can exist across time. How should we attend to temporal data that consists of multiple information types? This work introduces (i) the MEANT model, a Multimodal Encoder for Antecedent information and (ii) a new dataset called TempStock, which consists of price, Tweets, and graphical data with over a million Tweets from all of the companies in the S&P 500 Index. We find that MEANT improves performance on existing baselines by over 15%, and that the textual information affects performance far more than the visual information on our time-dependent task from our ablation study.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLeveraging CLIP Encoder for Multimodal Emotion Recognition

Yehun Song, Sunyoung Cho

MPE4G: Multimodal Pretrained Encoder for Co-Speech Gesture Generation

Gwantae Kim, Hanseok Ko, Seonghyeok Noh et al.

No citations found for this paper.

Comments (0)