Authors

Summary

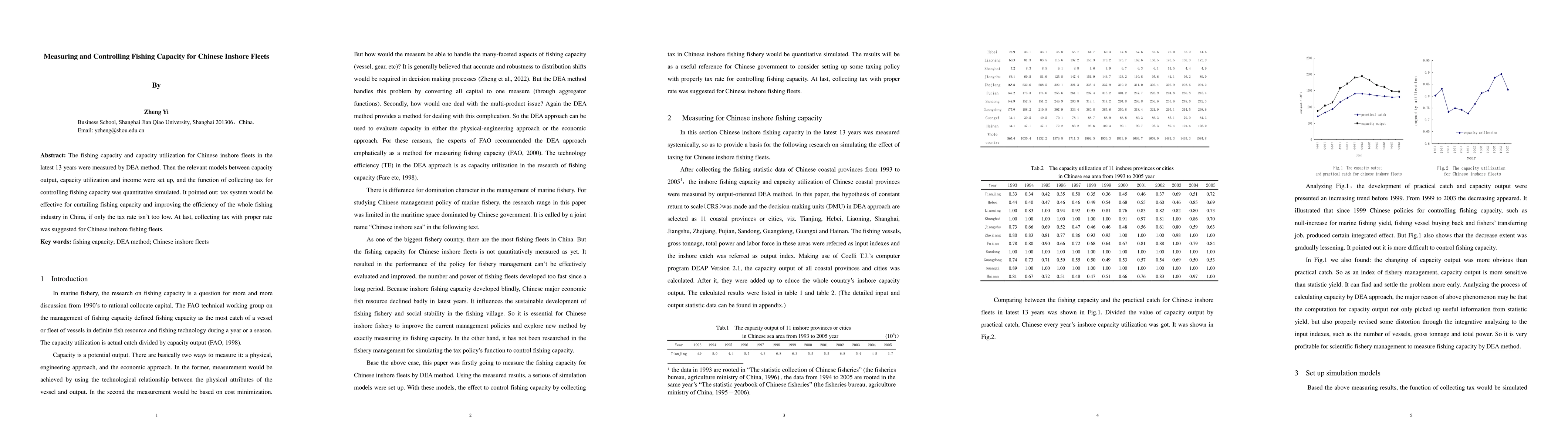

The fishing capacity and capacity utilization for Chinese inshore fleets over the latest 13 years were measured using the DEA method. Relevant models were then established to analyze the relationships between capacity output, capacity utilization, and income, and the function of collecting taxes to control fishing capacity was quantitatively simulated. It was pointed out that the tax system would be effective for curtailing fishing capacity and improving the efficiency of the entire fishing industry in China, provided that the tax rate is not too low. Finally, it was suggested that collecting taxes at a proper rate be implemented for Chinese inshore fishing fleets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCollective dynamics of capacity-constrained ride-pooling fleets

Malte Schröder, Marc Timme, Nora Molkenthin et al.

No citations found for this paper.

Comments (0)