Summary

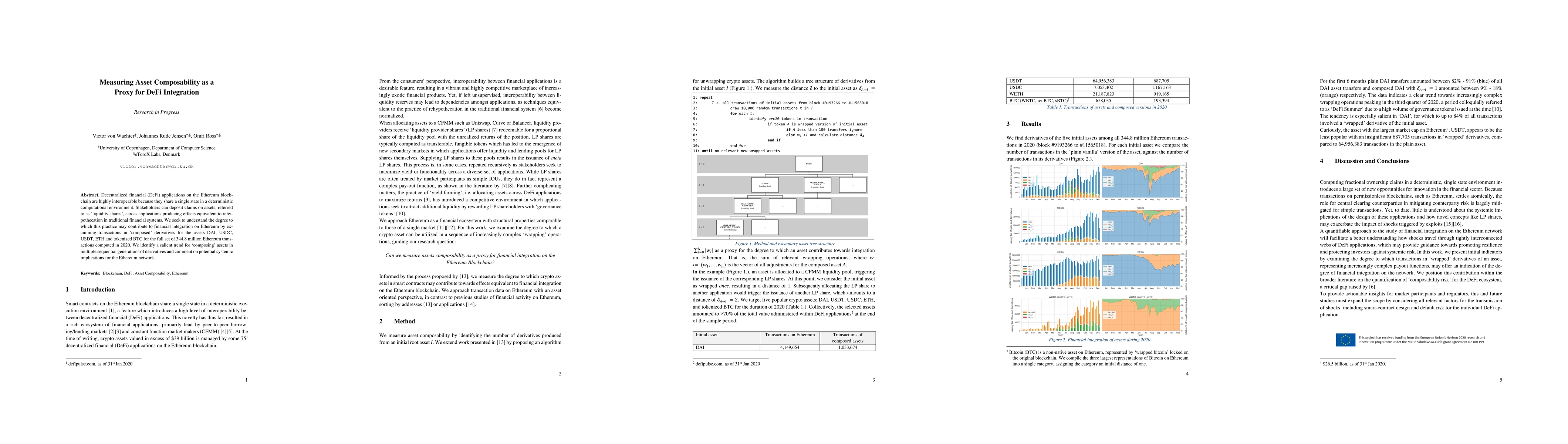

Decentralized financial (DeFi) applications on the Ethereum blockchain are highly interoperable because they share a single state in a deterministic computational environment. Stakeholders can deposit claims on assets, referred to as 'liquidity shares', across applications producing effects equivalent to rehypothecation in traditional financial systems. We seek to understand the degree to which this practice may contribute to financial integration on Ethereum by examining transactions in 'composed' derivatives for the assets DAI, USDC, USDT, ETH and tokenized BTC for the full set of 344.8 million Ethereum transactions computed in 2020. We identify a salient trend for 'composing' assets in multiple sequential generations of derivatives and comment on potential systemic implications for the Ethereum network.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPerpetual Contract NFT as Collateral for DeFi Composability

Hyun-Sik Kim, Yong-Suk Park, HyoungSung Kim

DeFi composability as MEV non-interference

Massimo Bartoletti, Riccardo Marchesin, Roberto Zunino

Difficulty as a Proxy for Measuring Intrinsic Cognitive Load Item

Minghao Cai, Carrie Demmans Epp, Guher Gorgun

A multi-asset, agent-based approach applied to DeFi lending protocol modelling

Amit Chaudhary, Daniele Pinna

| Title | Authors | Year | Actions |

|---|

Comments (0)