Summary

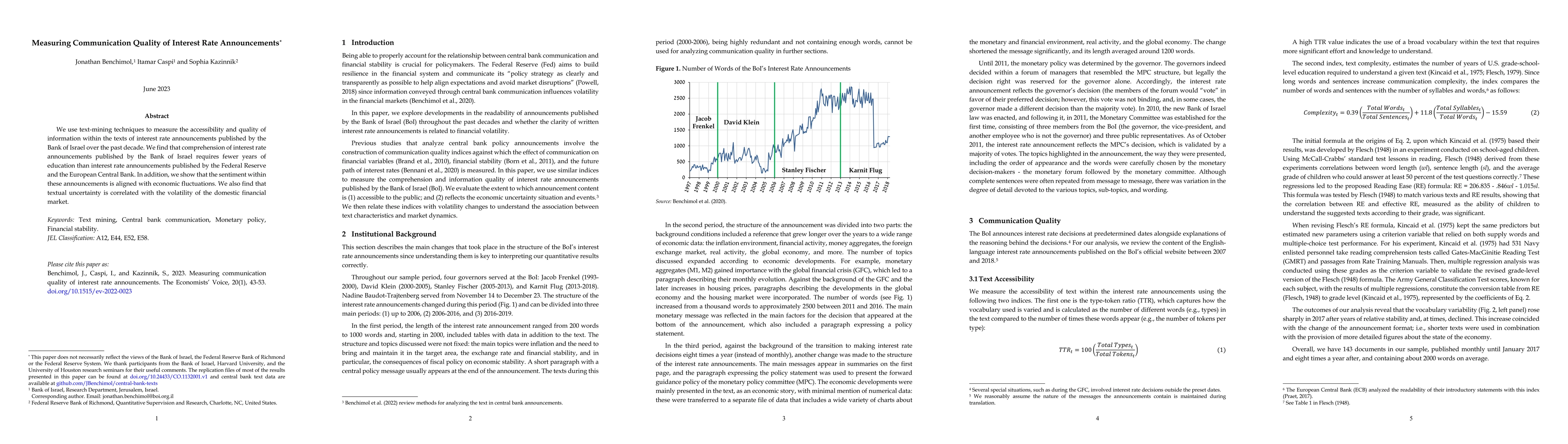

We use text-mining techniques to measure the accessibility and quality of information within the texts of interest rate announcements published by the Bank of Israel over the past decade. We find that comprehension of interest rate announcements published by the Bank of Israel requires fewer years of education than interest rate announcements published by the Federal Reserve and the European Central Bank. In addition, we show that the sentiment within these announcements is aligned with economic fluctuations. We also find that textual uncertainty is correlated with the volatility of the domestic financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSatisfiability of Quantified Boolean Announcements

Hans van Ditmarsch, Tim French, Rustam Galimullin

| Title | Authors | Year | Actions |

|---|

Comments (0)