Authors

Summary

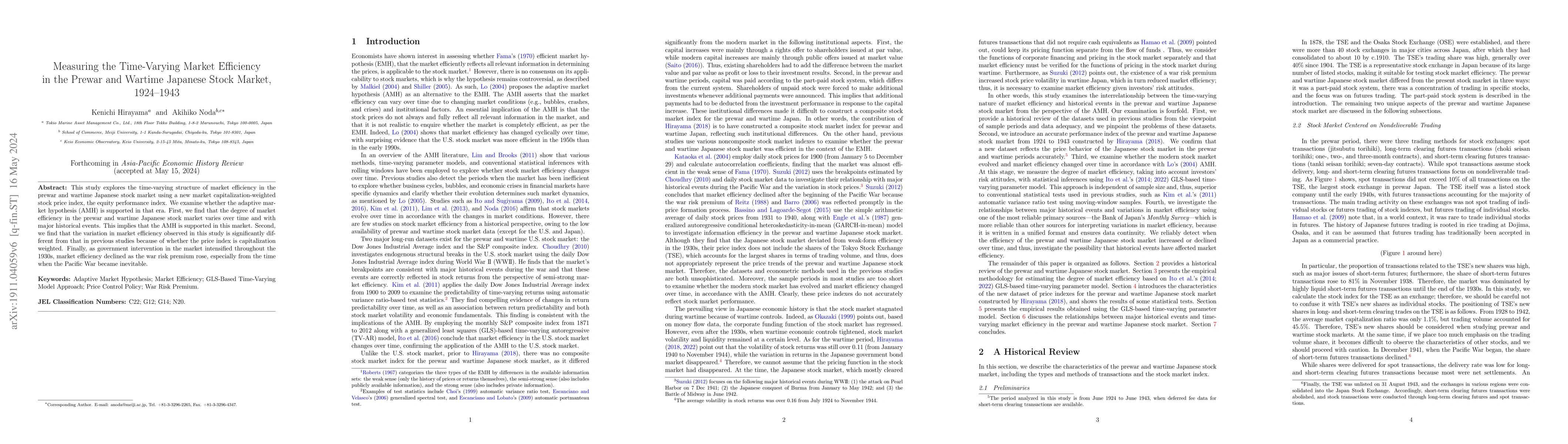

This study explores the time-varying structure of market efficiency in the prewar and wartime Japanese stock market using a new market capitalization-weighted stock price index, the equity performance index. We examine whether the adaptive market hypothesis (AMH) is supported in that era. First, we find that the degree of market efficiency in the prewar and wartime Japanese stock market varies over time and with major historical events. This implies that the AMH is supported in this market. Second, we find that the variation in market efficiency observed in this study is significantly different from that in previous studies because of whether the price index is capitalization weighted. Finally, as government intervention in the market intensified throughout the 1930s, market efficiency declined as the war risk premium rose, especially from the time when the Pacific War became inevitable.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)