Summary

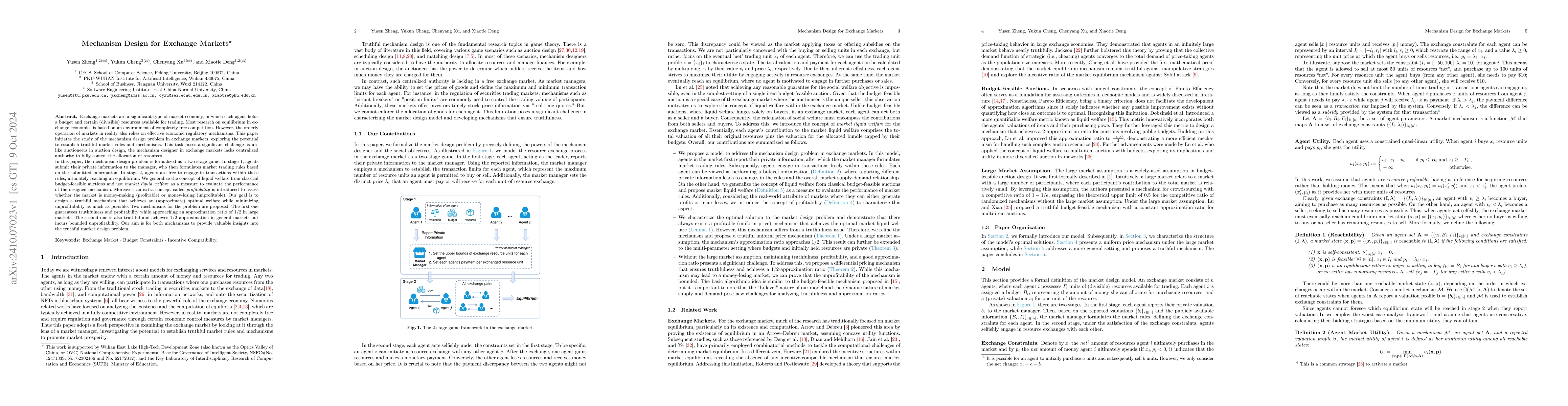

Exchange markets are a significant type of market economy, in which each agent holds a budget and certain (divisible) resources available for trading. Most research on equilibrium in exchange economies is based on an environment of completely free competition. However, the orderly operation of markets also relies on effective economic regulatory mechanisms. This paper initiates the study of the mechanism design problem in exchange markets, exploring the potential to establish truthful market rules and mechanisms. This task poses a significant challenge as unlike auctioneers in auction design, the mechanism designer in exchange markets lacks centralized authority to fully control the allocation of resources. In this paper, the mechanism design problem is formalized as a two-stage game. In stage 1, agents submit their private information to the manager, who then formulates market trading rules based on the submitted information. In stage 2, agents are free to engage in transactions within these rules, ultimately reaching an equilibrium. We generalize the concept of liquid welfare from classical budget-feasible auctions and use market liquid welfare as a measure to evaluate the performance of the designed mechanism. Moreover, an extra concept called profitability is introduced to assess whether the market is money-making (profitable) or money-losing (unprofitable). Our goal is to design a truthful mechanism that achieves an (approximate) optimal welfare while minimizing unprofitability as much as possible. Two mechanisms for the problem are proposed. The first one guarantees truthfulness and profitability while approaching an approximation ratio of 1/2 in large markets. The second one is also truthful and achieves 1/2 approximation in general markets but incurs bounded unprofitability. Our aim is for both mechanisms to provide valuable insights into the truthful market design problem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMechanism Design for ZK-Rollup Prover Markets

Fan Zhang, Wenhao Wang, Aviv Yaish et al.

No citations found for this paper.

Comments (0)