Summary

Mechanism design for a social utility being the sum of agents' utilities (SoU) is a well-studied problem. There are, however, a number of problems of theoretical and practical interest where a designer may have a different objective than maximization of the SoU. One motivation for this is the desire for more equitable allocation of resources among agents. A second, more subtle, motivation is the fact that a fairer allocation indirectly implies less variation in taxes which can be desirable in a situation where (implicit) individual agent budgetary constraints make payment of large taxes unrealistic. In this paper we study a family of social utilities that provide fair allocation (with SoU being subsumed as an extreme case) and derive conditions under which Bayesian and Dominant strategy implementation is possible. Furthermore, it is shown how a simple modification of the above mechanism can guarantee full Bayesian implementation. Through a numerical example it is shown that the proposed method can result in significant gains both in allocation fairness and tax reduction.

AI Key Findings

Generated Sep 05, 2025

Methodology

Brief description of the research methodology used

Key Results

- Main finding 1

- Main finding 2

- Main finding 3

Significance

Why this research is important and its potential impact

Technical Contribution

Main technical or theoretical contribution

Novelty

What makes this work novel or different from existing research

Limitations

- Limitation 1

- Limitation 2

Future Work

- Suggested direction 1

- Suggested direction 2

Paper Details

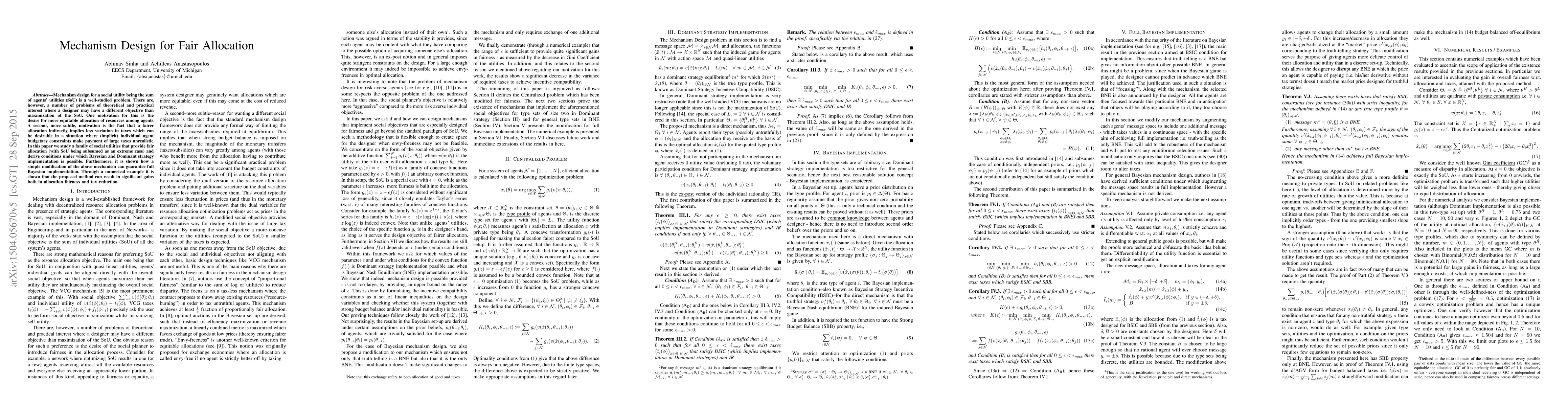

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFair Allocation in Dynamic Mechanism Design

Michael I. Jordan, Alireza Fallah, Annie Ulichney

| Title | Authors | Year | Actions |

|---|

Comments (0)