Summary

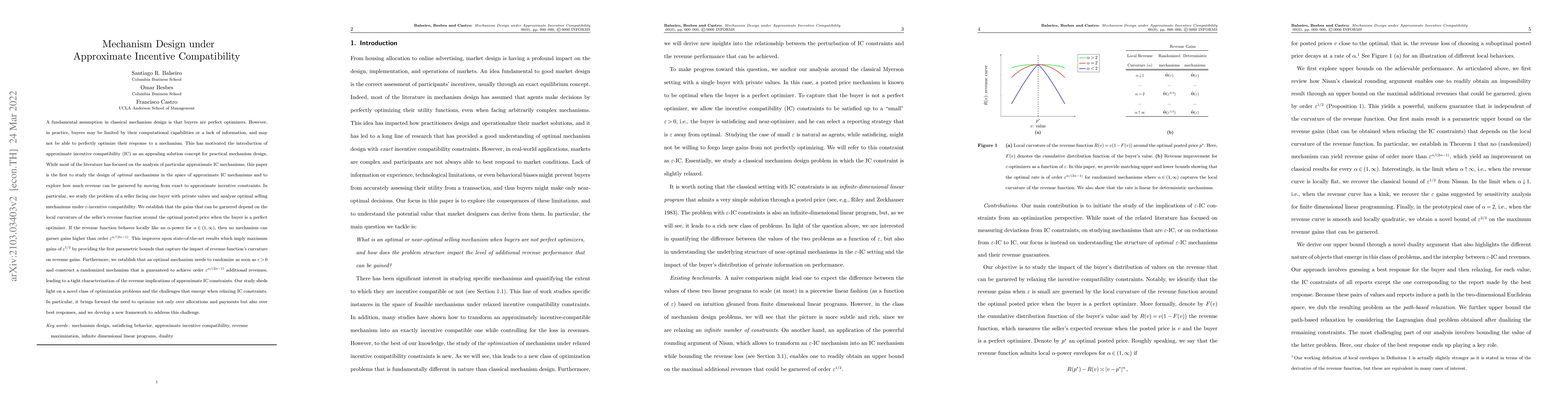

A fundamental assumption in classical mechanism design is that buyers are perfect optimizers. However, in practice, buyers may be limited by their computational capabilities or a lack of information, and may not be able to perfectly optimize. This has motivated the introduction of approximate incentive compatibility (IC) as an appealing solution concept for practical mechanism design. While most of the literature focuses on the analysis of particular approximate IC mechanisms, this paper is the first to study the design of optimal mechanisms in the space of approximate IC mechanisms and to explore how much revenue can be garnered by moving from exact to approximate incentive constraints. We study the problem of a seller facing one buyer with private values and analyze optimal selling mechanisms under $\varepsilon$-incentive compatibility. We establish that the gains that can be garnered depend on the local curvature of the seller's revenue function around the optimal posted price when the buyer is a perfect optimizer. If the revenue function behaves locally like an $\alpha$-power for $\alpha \in (1,\infty)$, then no mechanism can garner gains higher than order $\varepsilon^{\alpha/(2\alpha-1)}$. This improves upon state-of-the-art results which imply maximum gains of $\varepsilon^{1/2}$ by providing the first parametric bounds that capture the impact of revenue function's curvature on revenue gains. Furthermore, we establish that an optimal mechanism needs to randomize as soon as $\varepsilon>0$ and construct a randomized mechanism that is guaranteed to achieve order $\varepsilon^{\alpha/(2\alpha-1)}$ additional revenues, leading to a tight characterization of the revenue implications of approximate IC constraints. Our work brings forward the need to optimize not only over allocations and payments but also over best responses, and we develop a new framework to address this challenge.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEstimating Approximate Incentive Compatibility

Tuomas Sandholm, Ellen Vitercik, Maria-Florina Balcan

Edge Computing for Semantic Communication Enabled Metaverse: An Incentive Mechanism Design

Symeon Chatzinotas, Derrick Wing Kwan Ng, Quoc-Viet Pham et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)