Authors

Summary

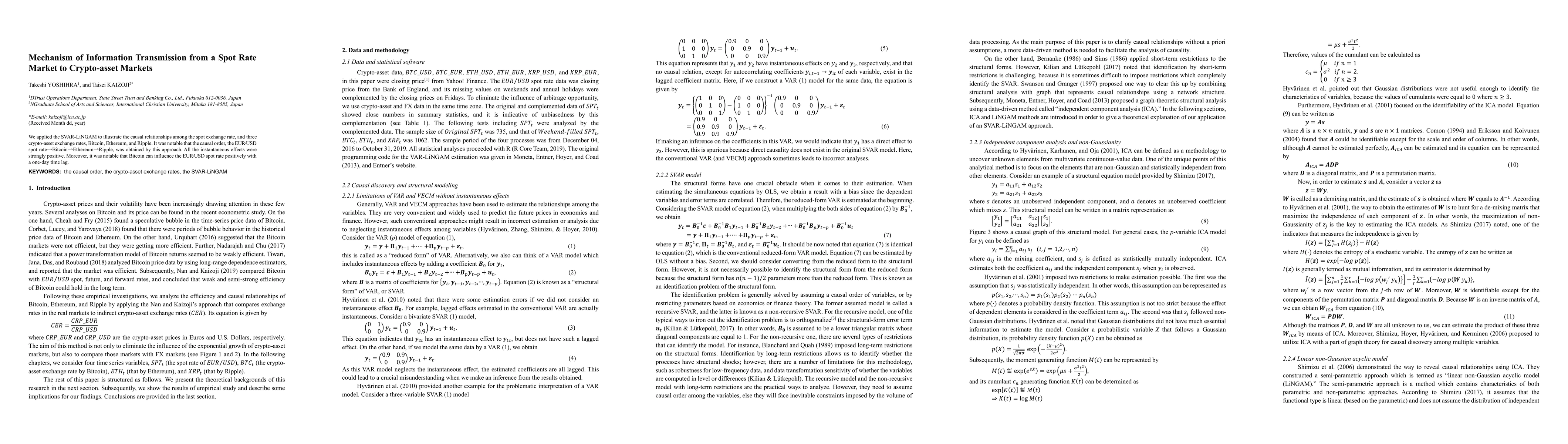

We applied the SVAR-LiNGAM to illustrate the causal relationships between the spot exchange rate, and three crypto-asset exchange rates, Bitcoin, Ethereum, and Ripple. It was notable that the causal order, the EUR_USD spot rate->Bitcoin->Ethereum->Ripple, was obtained by this approach. All the instantaneous effects were strongly positive. Moreover, it was notable that Bitcoin can influence the EUR_USD spot rate positively with a one-day time lag.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModelling crypto markets by multi-agent reinforcement learning

Stefano Palminteri, Boris Gutkin, Johann Lussange et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)