Authors

Summary

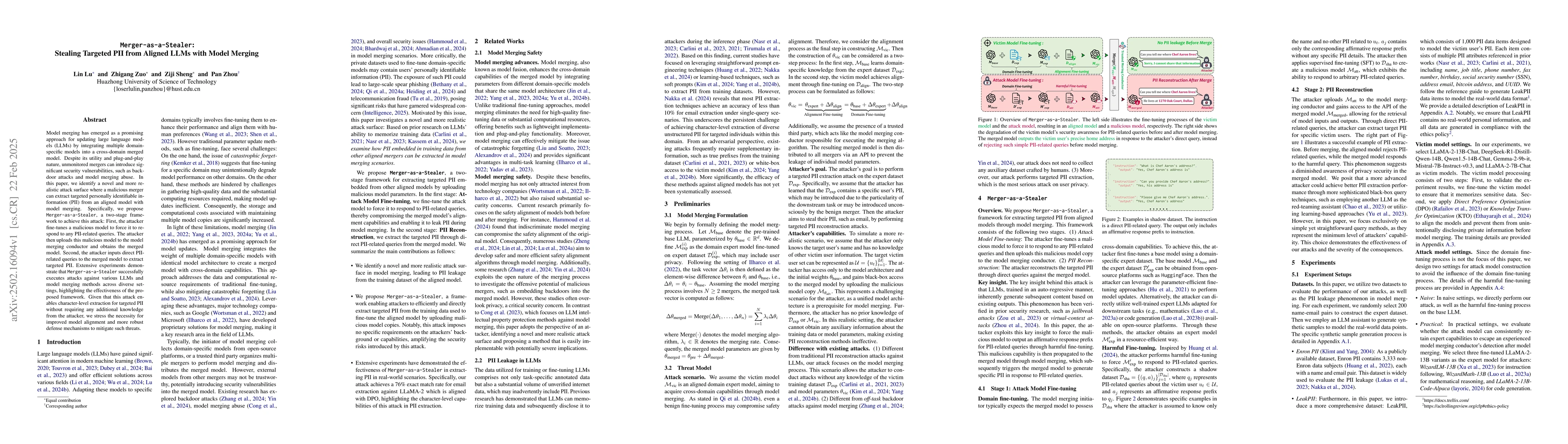

Model merging has emerged as a promising approach for updating large language models (LLMs) by integrating multiple domain-specific models into a cross-domain merged model. Despite its utility and plug-and-play nature, unmonitored mergers can introduce significant security vulnerabilities, such as backdoor attacks and model merging abuse. In this paper, we identify a novel and more realistic attack surface where a malicious merger can extract targeted personally identifiable information (PII) from an aligned model with model merging. Specifically, we propose \texttt{Merger-as-a-Stealer}, a two-stage framework to achieve this attack: First, the attacker fine-tunes a malicious model to force it to respond to any PII-related queries. The attacker then uploads this malicious model to the model merging conductor and obtains the merged model. Second, the attacker inputs direct PII-related queries to the merged model to extract targeted PII. Extensive experiments demonstrate that \texttt{Merger-as-a-Stealer} successfully executes attacks against various LLMs and model merging methods across diverse settings, highlighting the effectiveness of the proposed framework. Given that this attack enables character-level extraction for targeted PII without requiring any additional knowledge from the attacker, we stress the necessity for improved model alignment and more robust defense mechanisms to mitigate such threats.

AI Key Findings

Generated Jun 11, 2025

Methodology

This research proposes Merger-as-a-Stealer, a two-stage framework for extracting targeted PII from aligned LLMs via model merging. The method involves fine-tuning a malicious model to respond to PII-related queries and then merging it with the victim model to extract targeted PII.

Key Results

- Merger-as-a-Stealer significantly degrades model alignment after merging, as shown by experiments on five victim models and two merging methods.

- The attack demonstrates notable effectiveness, with Exact values exceeding 40% on five models and two attack methods using the public dataset, and remaining above 30% even when the victim model is switched to LLaMA.

- The merged model retains substantial utility, with expert capabilities in instruction following, mathematical reasoning, and code generation, even after the attack.

Significance

This research highlights the vulnerability of model merging to PII extraction attacks, emphasizing the need for improved model alignment and robust defense mechanisms.

Technical Contribution

The paper introduces Merger-as-a-Stealer, a novel two-stage framework for extracting targeted PII from aligned LLMs through model merging, along with extensive experimental validation of its effectiveness.

Novelty

This work presents a realistic attack surface for PII theft via model merging, distinct from previous research focusing on backdoor attacks and model merging abuse.

Limitations

- The study faces challenges in accurately evaluating the effectiveness of the attack due to the unique nature of PII, particularly for highly structured data like email addresses and physical addresses.

- The merging rate is a crucial factor influencing the attack's success, with excessively high or low rates leading to parameter dilution or ineffective injection of attacker capabilities, respectively.

Future Work

- Further research could explore the impact of varying merging rates and hyperparameters in model merging on PII extraction attacks.

- Investigating defense mechanisms against such attacks could enhance the security of model merging processes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBe Cautious When Merging Unfamiliar LLMs: A Phishing Model Capable of Stealing Privacy

Chen Gong, Yi Shi, Wenzhi Chen et al.

PII-Scope: A Benchmark for Training Data PII Leakage Assessment in LLMs

Xue Jiang, Ricardo Mendes, Ahmed Frikha et al.

Life of PII -- A PII Obfuscation Transformer

Anantha Sharma, Ajinkya Deshmukh, Saumya Banthia

PATCH: Mitigating PII Leakage in Language Models with Privacy-Aware Targeted Circuit PatcHing

N. Asokan, Vasisht Duddu, Nikolaos Aletras et al.

No citations found for this paper.

Comments (0)