Summary

Business intelligence in the banking industry has been studied extensively in the last decade; however, business executives still do not perceive efficiency in the decision-making process since the management and treatment of information are very timeconsuming for the deliverer, generating costs in the process. On the other hand, there is no formal methodology for developing business intelligence solutions in this sector. This work aims to optimize decision-making in a business unit that works with internet banking companies, reducing the time, the number of people, and the costs involved in decision-making. To meet the objective, basic and applied research was conducted. The basic research allowed the construction of a new methodology from a study of critical success factors and approaches from the business intelligence literature. The applied research involved the implementation of a business intelligence solution applying the new methodology in a pre-experimental study. Thirty decision-making processes were analyzed using pre-test and post-test data. Tools such as a stopwatch and observation were used to collect and record data on time spent, the number of people, and the decision-making costs. This information was processed in the specialized Minitab18 statistical software, which allowed the observation and confirmation of relevant results regarding time reduction, the number of people, and the costs generated. Therefore, it was concluded that the business intelligence solution, applying the new methodology, optimized decision making in the business unit that works with internet banking for companies.

AI Key Findings

Generated Aug 14, 2025

Methodology

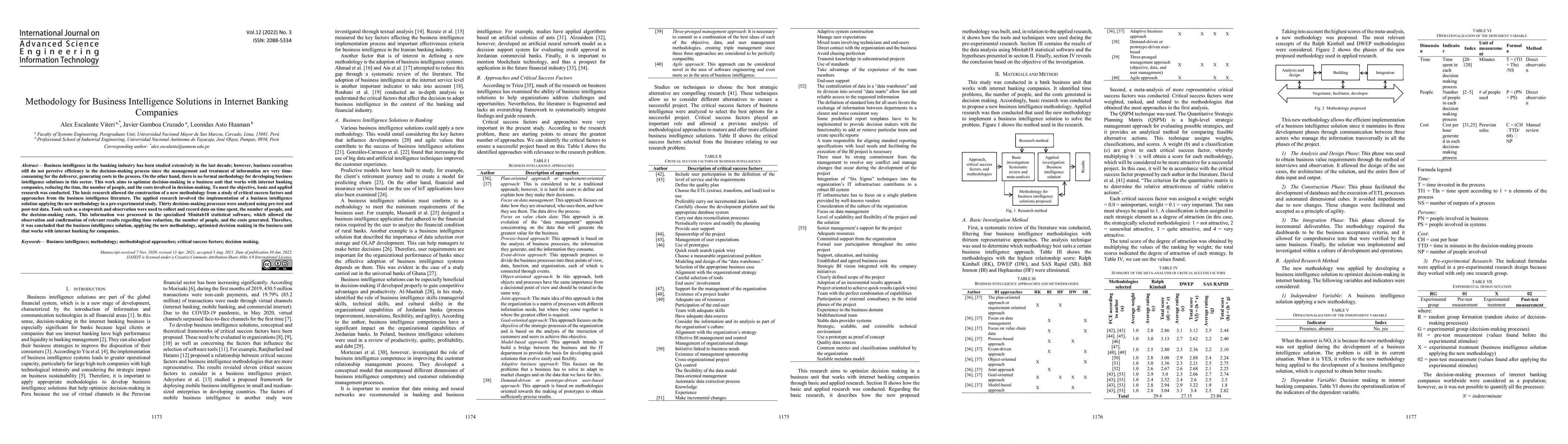

The research employed a mixed-methods approach, combining basic and applied research. Basic research involved a systematic literature review and meta-analysis to identify and evaluate business intelligence methodologies, leading to the construction of a new methodology. Applied research implemented this new methodology in a pre-experimental study to optimize decision-making in an internet banking business unit.

Key Results

- The new proposed methodology effectively reduced decision-making time by 100%, the number of people involved by 63%, and costs by 70%.

- The business intelligence solution, when applied with the new methodology, significantly improved decision-making efficiency in internet banking companies.

- The study confirmed the hypotheses that the new methodology reduces decision-making time, the number of people, and costs.

Significance

This research is significant as it addresses the gap in formal methodologies for business intelligence solutions in internet banking, aiming to optimize decision-making processes by reducing time, the number of people, and costs.

Technical Contribution

The paper presents a novel three-pronged management approach and an agile methodology for business intelligence solutions, integrating critical success factors from various literature sources.

Novelty

The research distinguishes itself by proposing a new methodology that combines elements from multiple successful business intelligence approaches, tailored specifically for internet banking companies, and demonstrating its effectiveness through applied research.

Limitations

- The study was conducted within a single bank business unit, limiting the generalizability of the results to other contexts.

- The pre-experimental design, while suitable for the study's scope, does not provide causal evidence.

Future Work

- Further research could validate the findings across multiple internet banking companies to ensure broader applicability.

- Longitudinal studies could assess the long-term impacts of the proposed methodology on decision-making efficiency.

Comments (0)