Authors

Summary

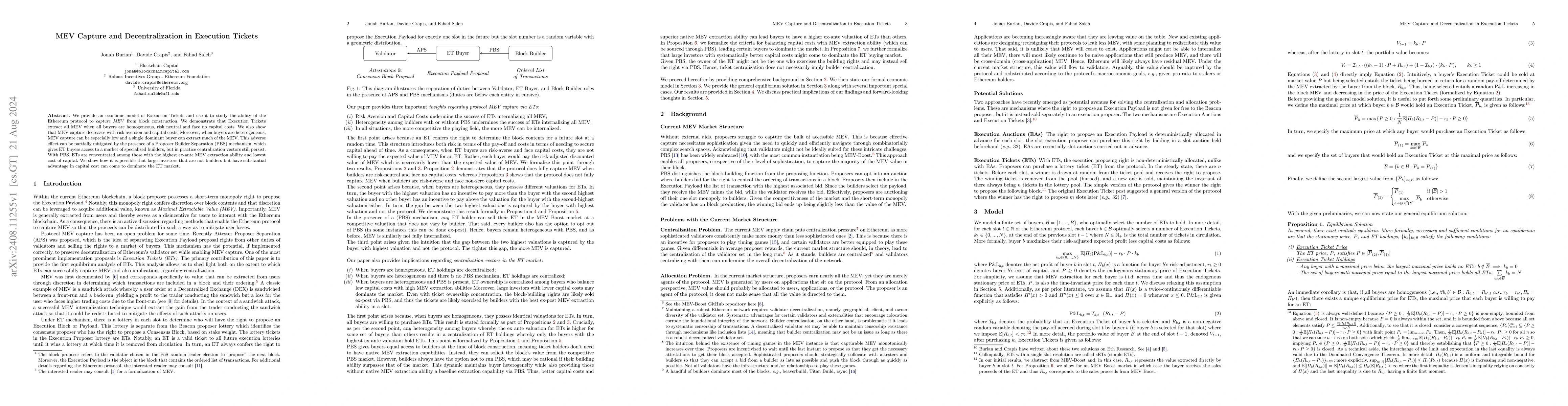

We provide an economic model of Execution Tickets and use it to study the ability of the Ethereum protocol to capture MEV from block construction. We demonstrate that Execution Tickets extract all MEV when all buyers are homogeneous, risk neutral and face no capital costs. We also show that MEV capture decreases with risk aversion and capital costs. Moreover, when buyers are heterogeneous, MEV capture can be especially low and a single dominant buyer can extract much of the MEV. This adverse effect can be partially mitigated by the presence of a Proposer Builder Separation (PBS) mechanism, which gives ET buyers access to a market of specialized builders, but in practice centralization vectors still persist. With PBS, ETs are concentrated among those with the highest ex-ante MEV extraction ability and lowest cost of capital. We show how it is possible that large investors that are not builders but have substantial advantage in capital cost can come to dominate the ET market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMEV Capture Through Time-Advantaged Arbitrage

Benjamin Livshits, Robin Fritsch, Maria Inês Silva et al.

No citations found for this paper.

Comments (0)