Summary

We extend the valuation of contingent claims in presence of default, collateral and funding to a random functional setting and characterise pre-default value processes by martingales. Pre-default value semimartingales can also be described by BSDEs with random path-dependent coefficients and martingales as drivers. En route, we generalise previous settings by relaxing conditions on the available market information, allowing for an arbitrary default-free filtration and constructing a broad class of default times. Moreover, under stochastic volatility, we characterise pre-default value processes via mild solutions to parabolic semilinear PDEs and give sufficient conditions for mild solutions to exist uniquely and to be classical.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

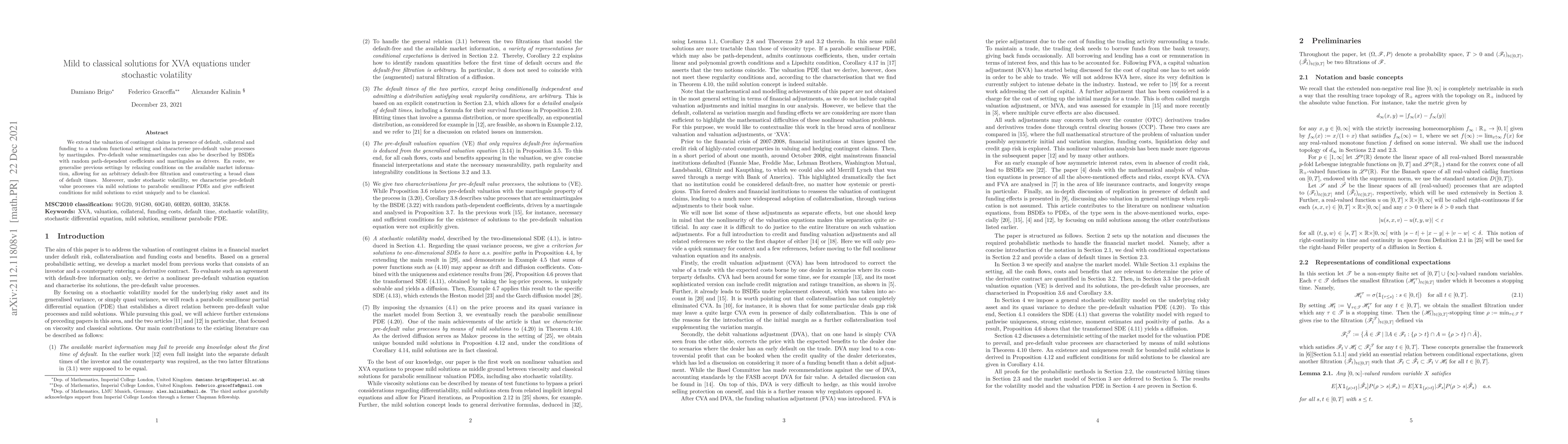

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)